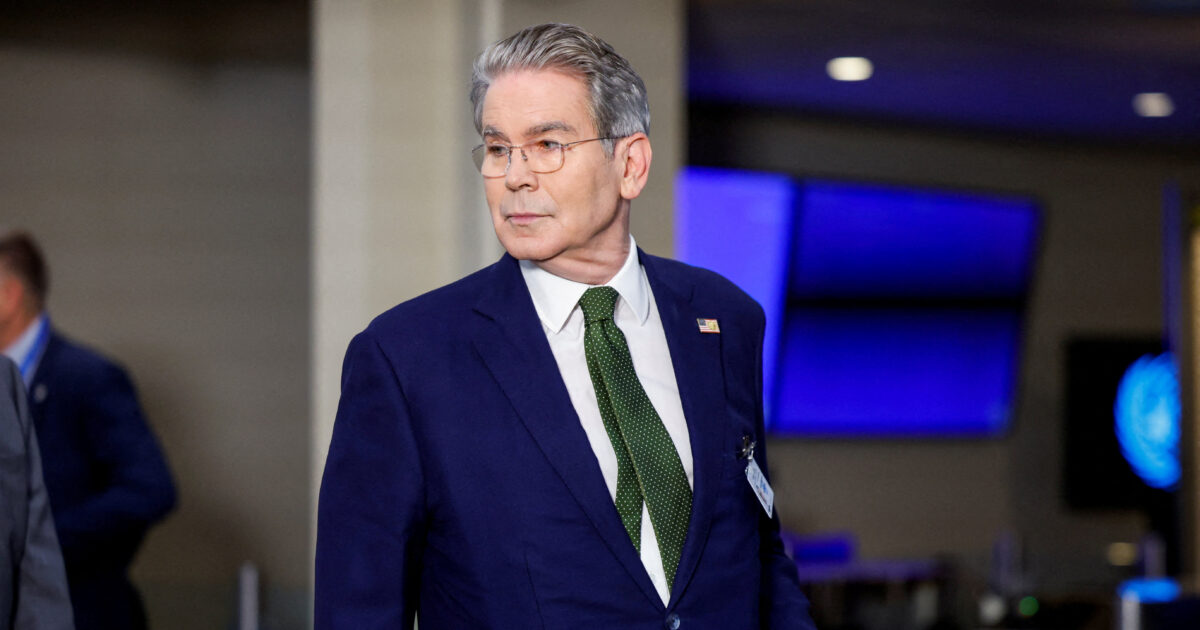

His support for his president Argentinean Javier Miley reiterated the US Finance Minister Scott Bessedtoday Thursday (2.10.2025), but warned that aid does not include immediate investments by the US, pushing bonds between profits and losses in a morning-like-like-like session.

Scott Bessed wrote on X today that the US will do “whatever is needed” to help Argentina, causing a rise to bonds. Shortly afterwards, he told CNBC that this does not mean that money would invest in the country, a warning that made bonds fall again. Now they are moving down.

The US had previously described at least three possible options to assist the country of South America, including a $ 20 billion exchange line, Argentinean debt repurchase and immediate currency market. Bessent’s comments on Thursday seem to have limited the options.

«We give them an exchange line, we don’t invest money in Argentina“, He told CNBC interview.

Argentine bonds in dollars in 2035 have fallen by 0.3 cents compared to the dollar at 51.45 centsdecreasing for the sixth consecutive day. The peso was opened with a slight change today, at 1,424.5 against the dollar. The limit of the transaction zone agreed with the International Monetary Fund is currently at 1,481.7.

Bessed also said in his post on X that he spoke on Wednesday (1.10.2025) with Argentinean Finance Minister Luis Kaputo, who, he said, would travel to Washington in the coming days to promote discussions about the “options”.

Yesterday, I had a very positive call with Minister @LuisCaputoAR of Argentina.

After intensive work since @POTUS Trump’s meeting with President @Jmilei in New York, in the coming days I look forward to Minister Caputo‘s team coming to D.C. to meaningfully advance our…

— Treasury Secretary Scott Bessent (@SecScottBessent) October 2, 2025

Dollars retreated from high levels of session “As investors assimilated clarifications” that American aid represents “a line of exchange and not a new liquidity infusion in dollars,” Walter Stoeppelwerth, CEO of Local Stock Exchange Grit Capital Group, wrote in a report.

The government was forced to spend millions of dollars and restore some controls to foreign exchange rates to prevent further depreciation of peso last week.

The fall of the coin is partly due to concerns about Miley’s political support in the face of the critical intermediate elections later held this month, and after the overwhelming defeat in the local elections in Buenos Aires in early September.

The US support announcement last week caused a significant rise to both the peso and the bonds in dollars. However, the enthusiasm was short -lived, as the currency was re -pressured from the growing demand for dollars and investors became skeptical about the timetable and form of US aid.