The trade war between the world’s two largest economies is in full swing, USA and China. Chinese exports to the US facing up to 245% and Beijing responds to 125% duties to US products. However, Washington finds it difficult to really squeeze China – And this is due to its broad commercial network and the control it exerts on the rare, critical for the global industry.

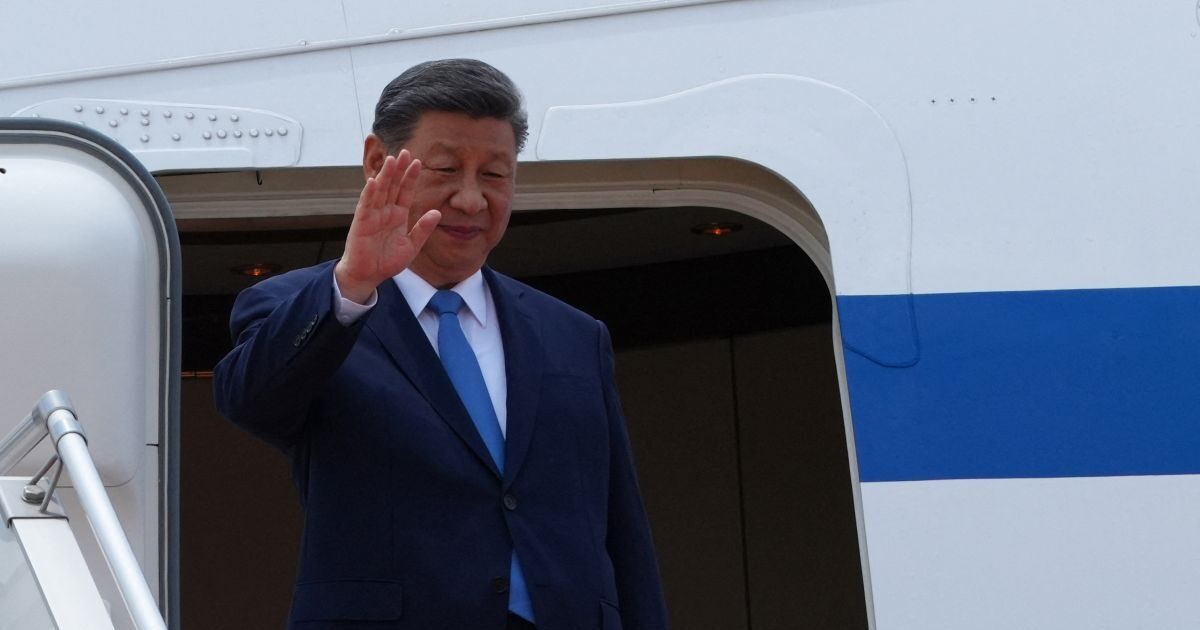

China’s Si Jing government has repeatedly stated that it is dialogue openbut expressing a disbelief about the intentions of the US president stressed that if needed, will ‘fight to the end’ While Trump in a change of tone – the result of internal pressure and efforts to reassure markets – referred to Possible “substantial” reduction in duties imposed on China products.

For his pirouette he went viral to Chinese social media with the Hashtag “Trump has been dying” (Trump chickened out) to have over 150 million views on Weibotoday Thursday (24.04.2025).

In accordance with BBCBeijing has some strong papers in his hands in the trade war with Trump who is not thinking of burning.

No. 1: China can withstand cost (up to a point)

China is the second largest economy in the world, which means it can absorb the impact of duties better than other smaller countries. With more than one billion inhabitants, it has a huge internal market that could lighten the pressure from exporters suffering from tariffs.

At the same time, Beijing is still addressing issues because the Chinese do not spend enough. However, with a series of incentives, from subsidies for home appliances to “silver trains” for traveling pensioners, this could be changed.

Trump’s duties gave the Chinese Communist Party an even greater impetus to unlock the country’s consumer potential, the British media notes.

However, the turmoil is alarming, especially because there is economic uncertainty and dissatisfaction with the ongoing real estate crisis and job losses.

The Chinese leadership cites national interests to justify the retaliation for duties, with state media calling citizens to “face storms together”.

President Xi Jinping may be worried, but so far Beijing has kept a disobedient and Full of confidence tone.

No. 2: Beijing invests in the future

China has always had the reputation of the world’s factory, but has invested billions to become a much more advanced factory. Under Si Jing, he is in a US road race for technological domination.

It has largely invested in domestic technology, from renewable energy to chips and artificial intelligence.

Examples include the chatbot DeepSeekwhich was described as a great opponent of Chatgpt, and BYD, who won Tesla last year to become the largest electric vehicle manufacturer in the world. Apple has lost its valuable market share of local competitors such as Huawei and Vivo.

Recently Beijing has announced that it plans to spend more than $ 1 billion in the next decade on artificial intelligence.

US companies have tried to move their supply chains from China, but found it difficult to find the same quality infrastructure and specialized workforce elsewhere.

Chinese manufacturers at every stage of the supply chain have given the country a decades of advantage that it will take time for the US to reach it.

This unparalleled know -how in the supply chain and government support has made China a terrible opponent in this trade war – in some ways, Beijing was prepared for him from Trump’s previous term.

No. 3: Classes from Trump 1.0

Ever since Trump’s duties hit Chinese photovoltaics in 2018, Beijing has accelerated plans for a future beyond a world -leading class under the US leadership, the BBC notes.

It has channeled billions to a controversial trade and infrastructure program to enhance the links with the so -called global south.

Extension of trade with Southeast Asia, Latin America and Africa comes as China is trying to get rid of the US.

US farmers once supplied 40% of China’s soy imports – this figure is now at 20%.

After the last trade war, Beijing increased soy cultivation inside and bought record quantities from Brazil, which is now the largest soy soyal supplier for China.

China was the largest trading partner for 60 countries in 2023 – almost twice as much as the US. The largest exporter in the world has recorded a surplus record of $ 1 billion at the end of 2024.

This does not mean that the US, the world’s largest economy, is not a critical trading partner for China. But it means that it will not be easy for Washington to squeeze China in the corner.

Following the reports that the White House will use bilateral trade negotiations to isolate China, Beijing warned countries against “reaching an agreement against China’s interests”. This would be an impossible choice for most of the world.

No. 4: China knows when Trump will retreat

Trump remained unmoved as the shares were falling sharply after his sweep duties announced in early April, likening his escalating burdens to “medicine».

However, he proceeded with a colotube, suspending most of these duties for 90 days after a sharp sale of US government bonds.

These are also known as treasuries, which have long been considered as a safe investment. But the trade war has shaken confidence. Since then Trump has implied that there will be a decline in commercial tensions with China, saying that tariffs on Chinese products “They will be significantly reduced, but they will not be zero.”

Thus, experts point out, Beijing now knows that Purchase bonds can shake Trump.

China also owns $ 700 billion in US government bonds. Japan, a stable US ally, is the only non -American holder who has more of them.

Some argue that this gives Beijing advantage: Chinese media regularly display the idea of selling or withholding US bonds as a “weapon”.

However, experts warn that China will not come out of such a situation.

No. 5: the weapon of rare earths

What China can exploit, however her monopoly on mining and refinement of rare eartha series of elements that are important for the manufacture of advanced technologies.

China has huge deposits, such as inaccessible, used in magnets in electric vehicles and wind turbines, and the high, which provides a heat -resistant coating for aircraft aircraft engines.

Beijing has already responded to Trump’s latest duties by limiting the exports of seven rare land, including some that are necessary for the manufacture of artificial intelligence chips.

China accounts for about 61% of rare land production and 92% of their refinement, according to estimates by the International Energy Organization.

Although Australia, Japan and Vietnam have begun to mining rare earths, it will take years for China cut off the supply chain, the BBC said.

In 2024, China banned the export of another critical mineral, the antimonization, which is vital to various construction processes. Its price was more than doubled amidst a wave of panic -stricken markets and search for alternative suppliers.

The fear is that the same can happen in the market of rare earths, which will seriously disturb various industries, from electric vehicles to defense.