Its shares fell Wall Street on Thursday (20.11.2025), as the market recovery caused by the impressive results and forecasts of Nvidia has lost momentum and investors have given up hope that the Fed will cut rates again in December.

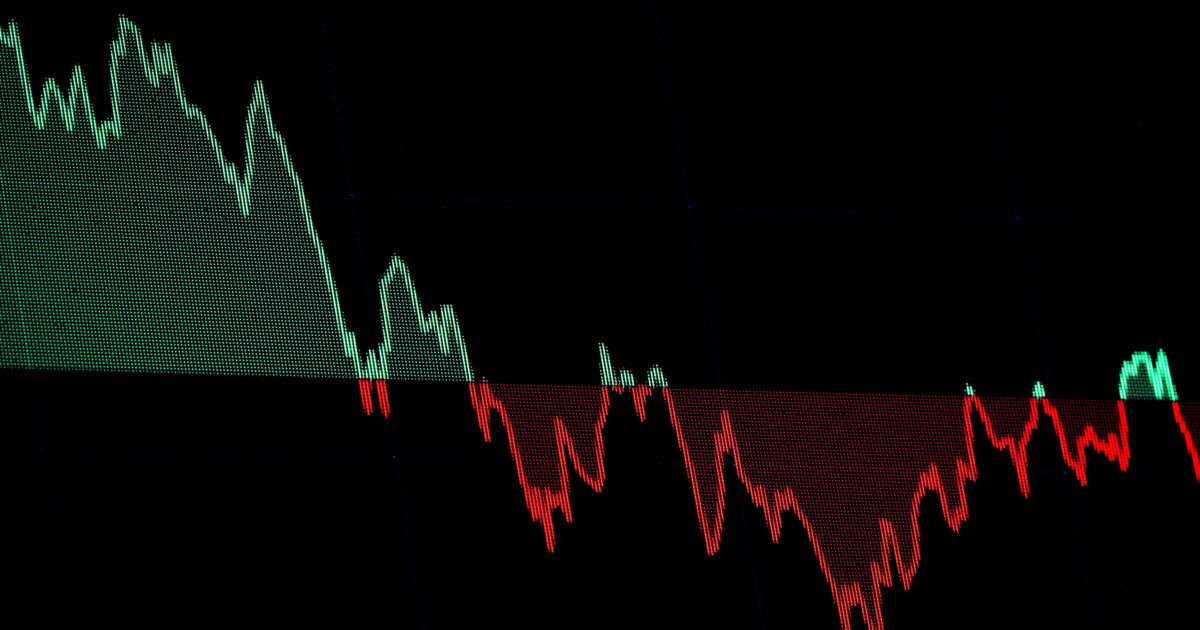

After the reversal in AI and Nvidia, Wall Street’s Dow Jones Industrial Average fell 386.51 points, or 0.84%, to 45,752.26, after rising more than 700 points to session highs.

Meanwhile, the S&P 500 fell 1.56% to 6,538.76, while the Nasdaq Composite fell 2.16% to 22,078.05, despite both indices having risen 1.9% and 2.6% earlier in the session.

Nvidia’s reversal dragged down the broader market. Shares had risen as much as 5% after the microprocessor maker reported better-than-expected quarterly results and an upbeat forecast for fourth-quarter sales.

However, the stock ultimately closed down 3%, despite CEO Jensen Huang’s assurances that demand for current-generation Blackwell chips is “off the scale.” He also rejected the idea of an artificial intelligence bubble.

However, concerns about AI stock valuations have returned, with investors also wondering about the impact on the sector if the Fed does not cut rates further. Oracle and AMD were among the first AI companies to fall into the red during the session, followed by Nvidia.