The reduction of tax rates by 2 units for allwith additional reductions in families By child, Prime Minister Kyriakos Mitsotakis announced today (06.09.2025).

As Kyriakos Mitsotakis pointed out this is about Greater reform in tax rates throughout the Transfigurationwhile targeting is the Greater support for families with childrenin the context of dealing with the demographic problem.

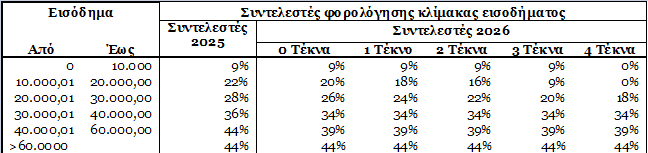

Indicative:

- for income 10,000–20,000 euros The rate of 22% is 18% with one child, 16% to two, 9% for three -year -olds and zero for multiple children.

- In 20,000 eurosthe annual benefit is about 600 euros with two children, 1,300 euros with three and 1,680 euros with four.

- In 30,000 eurosthe benefit is 400 euros without children, 800 with one, 1,200 with two, 2,100 to three and 4,100 with four.

- For income 40,000–60,000 euros A 39% intermediate coefficient is established instead of 44% today.

In detail, the table with the new rates:

The new income tax rates, which will be valid from 01.01.2026 while the technical details will be presented at the press conference on Monday (08.09.2025).