Pensioners will see a barrage of increases next November and December. According to what he announced today (8.9.25) the MinistryIn addition to the benefit that pensioners will see from January 2026 with the reform of the income tax scale and the reinforcement of 250 euros each November, from January 2026, increases in the pensions at a budgetary cost of € 542 million.

Specifically, pensions are further increased basis for inflation and GDP, the Ministry said. With the present macroeconomic forecasts, the increase is estimated at 2.35% today and the budgetary costs of € 467 million.

In the case of pensioners working to calculate the solidarity contribution of pensioners, it will be done without counting the increase in the pension due to the pensioner’s work.

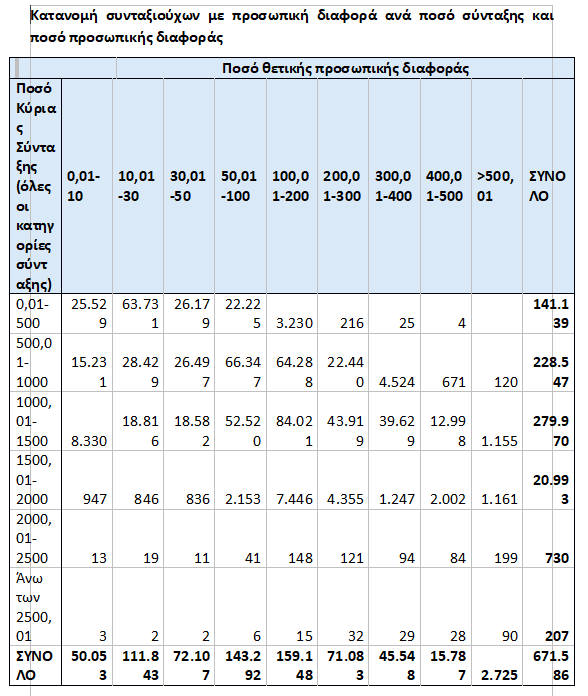

From January 2026 and on a permanent basis, all pensioners will receive an increase in inflation and GDP as 50% of the personal difference will not be offset by increasing pension, while by January 2027, the personal difference is completely settled by increasing pension. The budgetary costs are estimated at EUR 75 million for 2026, increasing by an additional EUR 135 million in 2027, EUR 113 million in 2028, EUR 106 million in 2029 etc. Immediate beneficiaries are approximately 671,000 pensioners with a personal difference.

Indicative examples

- A pensioner with 10,000 euros in taxable income and a monthly net income of € 823 will receive 214 euros net from the GDP and inflation base and 250 euros from the November boost, a total of 464 euros net. If subject to a personal difference it will receive 357 euros net.

- A pensioner with 14,000 euros in taxable income and a monthly net income of 1080 euros will receive 263 euros net from the GDP and Inflation Base, 250 euros from November boost and 80 euros in income tax reduction, a total of EUR 593 net. If subject to a personal difference it will receive 462 euros net.

- A pensioner with 20,000 euros in taxable income and monthly net income of 1460 euros will receive 376 euros net from the GDP and inflation base and 200 euros in income reduction, a total of 576 euros net. If subject to a personal difference it will receive 388 euros net.

- A pensioner with 24,000 euros in taxable income and a monthly net income of 1693 euros will receive 417 euros net from the GDP and Inflation Base increase and 280 euros in income tax reduction, a total of 697 euros net. If subject to a personal difference it will receive 489 euros net.