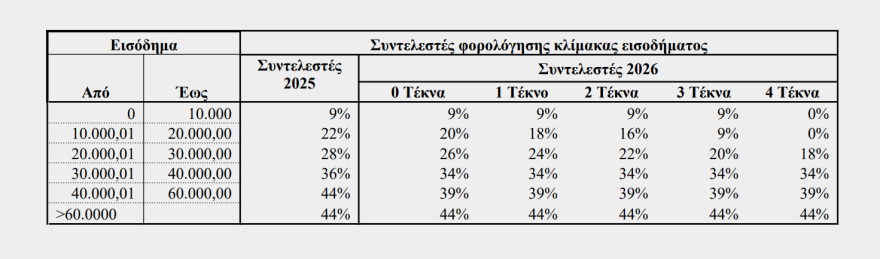

The “boldest income tax reform in the history of the opposition of a 1.6 billion euro intervention” announced from the 89th TIF step by the Prime Minister, Kyriakos Mitsotakisresetting tax rates for families with 4 children, as well as young people who enter the labor market for the first time.

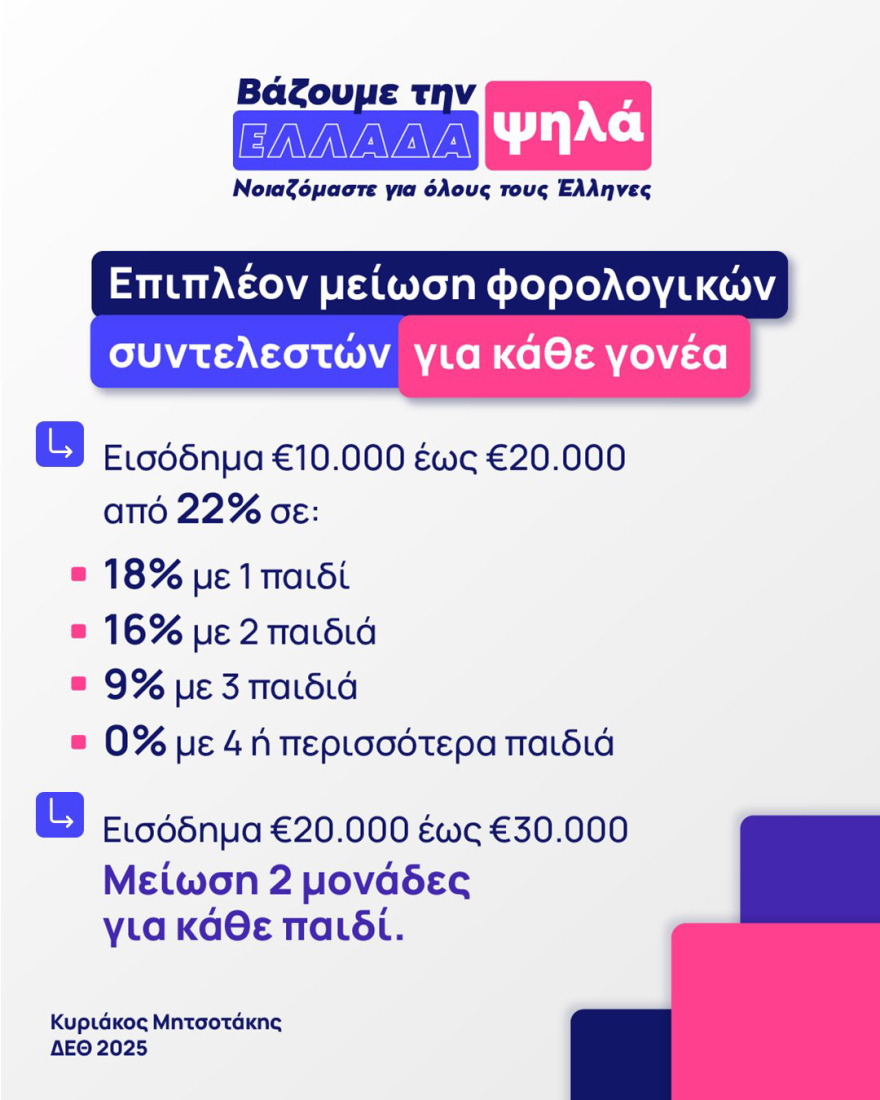

Mr Mitsotakis spoke of the “middle class time, the time of families and the younger generation”, while announcing the reduction of tax rates for approximately 4,000,000 beneficiaries, as, for example, the rates will submit to each child by 2% as a result of the quiet, but substantial years.

Mr. Mitsotakis stressed permanent measures, announcing a lower ratio for rents from 12,000 – 24,000 euros and added that “we reduce tax rates by 2 points for all”.

Detailed examples:

For income of 10,000-20,000 euros:

• from 22% to 18% with one child, 16% to two children, 9% for three -year -olds, zero for many children.

• Another annual benefit of 20,000 euros: with 2 children 600 euros, with 3 children 1,300 euros, with 4 children 1,680 euros.

For income of 30,000 euros:

• Annual benefit: Without children 400 euros, with 1 child 800 euros, with 2 children 1,200 euros, with 3 children 2,100 euros, with 4 children 4,100 euros.

For income of 40,000 – 60,000 euros:

A 39% intermediate rate from 44% today is established.

“Our most important intervention concerns young people”

“Our most important intervention is for young people,” Prime Minister Khan said, announced zero tax for employees up to 25 years and up to 20,000 euros – and a decrease to 9% from 22% to their 30s.

The initiative for young people:

-To 25 years old, with 15,000 euros: Annual benefit of 1,283 euros

-To 25 years old, with 20,000 euros: Annual benefit of 2,480 euros

-From 26-30 years, with 20,000 euros: Annual benefit of 1,300 euros

He also stated open to further reductions in real estate rental taxation depending on the course of real rental statements, while announcing the construction of 2,000 homes in Patras, Thessaloniki and Athens.

ENFIA zero from now on 2027 and reduced by 50% in 2026 in the first villages below 1,500 inhabitants, as it is reduced by 30% in 2026 and reset VAT on the islands under 20,000 inhabitants.

The prime minister also focused on earnings for salaries for uniforms and diplomats, after the upgraded salary of Armed Forces, Greek Police, Fire Brigade, Coast Guard-Greek Coast Guard and Diplomatic Corps will enter into force.

For retirees, the personal difference is reduced by half in 2026 and is completely abolished in 2027, offering an additional benefit to 671,000 pensioners -beyond the relief from the new rates.

“It’s a comprehensive reform plan,” the prime minister said, even saying that “we know how to recognize mistakes”, having reiterated twice that he knows deeply about the problem that households are facing accuracy.

Mitsotaki posts in X

“We are announcing today a plan that relieves more than 4 million taxpayers at the same time. This means automatically and permanently increasing income to employees and professionals, farmers and retirees. But especially in families and young people » The prime minister said in his posts on the X platform that he accompanied with relevant tables.

Did Mr. Mgsotakis still note? “We support our young people in practice. No employee up to 25 years of age with revenue of up to € 20,000 will pay tax.

The personal difference falls in half in 2026 and is completely abolished by 2027. An additional benefit to our pensioners, beyond the relief by the new contributors.

2026 is reduced by half ENFIA in the main settlements below 1,500 residents and is abolished in 2027. An incentive to remain or even return parents and children to their places. At the same time, VAT is reduced to 30% of the islands under 20,000 inhabitants.

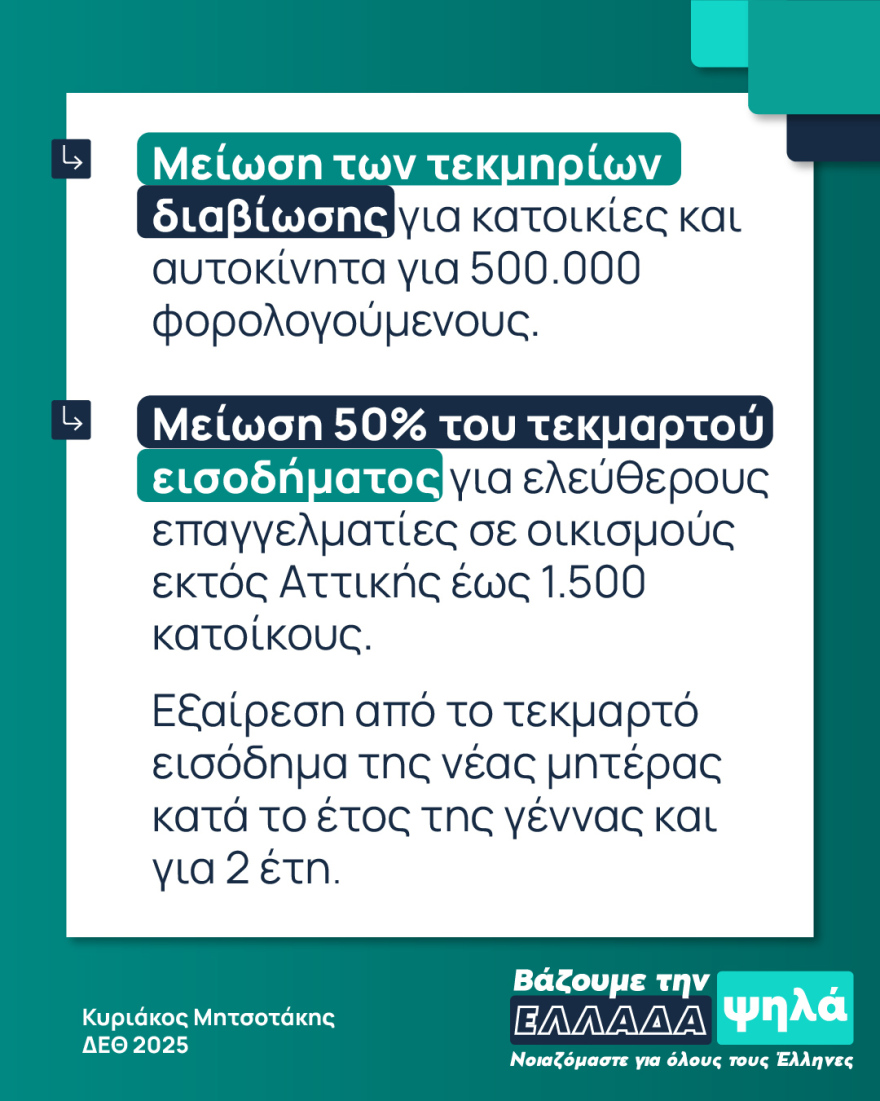

We reduce living presumptions for homes and cars for 500,000 taxpayers. The favorable criteria for freelancers in settlements up to 1,500 residents are expanded. While we introduce a 25% rate for rent income from € 12,000 to € 24,000.

See tables

Marinakis: I have good news for you …

The prime minister announced the 8 most important measures that the prime minister reported on Instagram by government spokesman Pavlos Marinakis.

“TIF package” with increases and tax breaks for everyone and new agenda by Mitsotakis

Mercury Psilakis: Dinner surfer, businessman, father of a little girl – who was the Greek Greek who was lost in the shark teeth