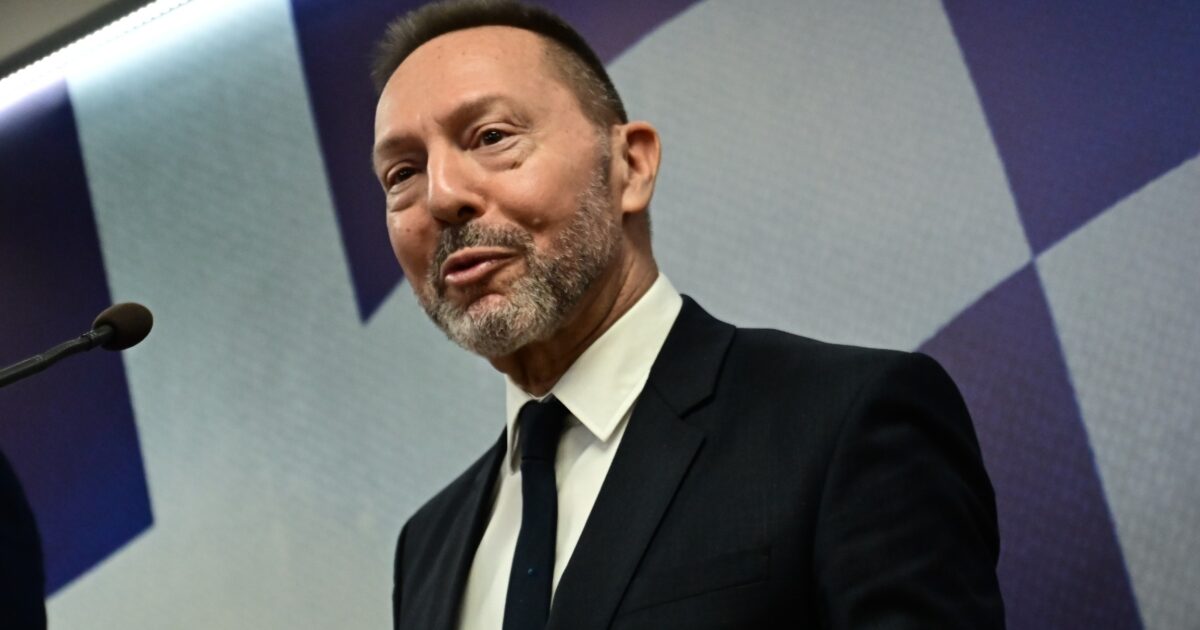

Eurosystem is ready to accelerate the process of introducing digital euro Once the relevant legislation has been approved and adopted, the Bank of Greece Governor (BoG) said, among other things. Giannis Stournarasspeaking today (29.9.2025) at Crypto-Research Conference, held at the National and Kapodistrian University of Athens.

As Yiannis Stournaras pointed out, the political dialogue on the digital euro legislative package in the European Union’s institutions, which will soon be completed, is ongoing.

Referring to the objectives of the digital euro to achieve, Mr Stournaras pointed out that it aims to boost monetary sovereignty in retail payments, reducing dependence on shapes and providers outside the euro zone.

- It can ensure wide and cost access to a digital media of retail payments for all citizens, contributing key to social inclusion.

- It provides a safe and reliable alternative to digital retail payments, which will always be available to users and will operate under strict and fully transparent public supervision rules.

- It creates new innovation opportunities for banks and payment institutions that will offer digital euro to their customers in conjunction with other financial services. Thus, it can enhance the payment ecosystem with the least possible financial burden.

- It aims to be a resilience tool that will support the continuation of financial transactions in cases of crisis or geopolitical abnormalities, where private payment networks could be disturbed.

In any case, as he said in the new environment that is being created, although the acceptance of cash remains broad, but their use recedes, central banks and Eurosystem are closely monitoring the use of cryptocurrencies in payments, but at the same time recognizing that the retail money and central bank money will also have to hug new technologies.