An impressive increase in rental Student apartments is still recorded in Greece, according to Geoaxis Observatory which records the basic trends of 2025 for the student residences in the territory.

The increase is observed in all 6 areas where Geoaxis researched in Athens in Zografou, Campus, Goudi, Ilisia, in the center of Thessaloniki, in the center of Patras, in Heraklion, Volos and Komotini. This is as the imbalance between supply and demand lays rentals in student houses.

The absence of new affiliates and the short -term lease effect have an extremely negative impact on supply. The percentage of the increase in the requested rents compared to last year is average at 7.3% while at 110% before 110%. Private student homes and the mood for co -habitation are the new rising trends.

Research confirms the fact that Athens is the city with the highest and Komotini the city with the lowest rental prices of typical, old, student apartments. With 10 years before the requested prices, 110% increased at a middle of average with 147%. More specifically:

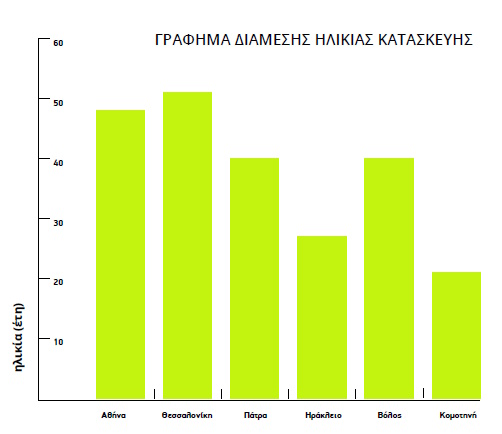

Ages of student apartments

On the ages, as expected, older student apartments are recorded in Thessaloniki (center) with a median age of 51 years. It follows Athens with a median age of 48 years, Volos and Patras with 40 years and Heraklion Crete with 27 years. Komotini records the younger median age with 21 years.

In conclusion, a typical student compartment has an average age of 30 to 45 years.

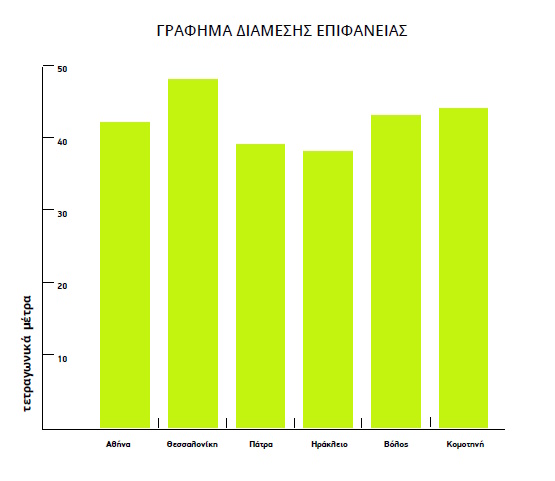

Student apartments surfaces

The largest student apartments are recorded in Thessaloniki with a median surface of 48sqm. Following is Komotini with 44sqm, Volos with 43sqm, Athens with 42sqm, and Patras with 39sqm. The smallest median of student apartments were recorded in Heraklion, Crete with 38sqm.

In conclusion, a typical student compartment has an average surface of 40 to 45 sqm.

Student apartments lease features

Student apartments, along with data centers and retirement homes, have proven in a pan -European context the most durable investment real estate due to steadily increased demand regardless of the economic cycle. Clearly fewer student apartments are available in the market compared to 2016, as a percentage of real estate about 15 – 25% has finally entered short -term lease. The offer of student apartments is expected to make a further decrease due to increased tourism.

Indicatively, in the Zografou we had an increase in registered real estate on short -term platforms of 17% compared to last year, and 30% over 2023. More and more owners are limited apartment furnishings to have a competitive advantage.

As students begin and choose the subject of their studies based on the University’s headquarters rather than the subject, demand in the future is expected to intensify near major universities and reduce the province. The majority choose to rent as much as possible, while an increase in students who choose to co -operate to divide the costs are recorded.

As a result, the largest apartments are gradually lowering lower risk. In recent years, the efforts of real real estate players have intensified to create homes in private student home standards, as it is now found that with the offering of additional services this form of development can generate more significant revenue.

Private student halls

A new market is being developed around private student halls “All Inclusive” where its advantages compared to typical student apartments are:

- The price includes all services and accounts (such as cleaning, storage, electricity, water, heating, internet and use of public spaces),

- Standardization of apartments and the unique choice of accepting the full benefit package is extremely facilitated by management,

- High security to tenants (card entry system, cameras, guard) is evaluated as the most important advantage,

- Apartments are fully renovated and furnished,

- are near schools or very close to public transport,

- There is – in some cases – the possibility of a flexible lease depending on the period of attendance,

- The rate of increased rent over typical student apartments ranges from 20 – 40%, depending on the city.

As the quality of existing (state) university student homes are considered to be tolerable as frustrating, while their numerical deficiency is a given, the fast -growing demand hastened to exploit many private companies from all over the real estate market, The trend of investment in this sector is expected to intensify significantly.

Typical residences vs private student homes

Leasing a typical home and staying in a private student home are two basic and diametrically different options for students looking for housing during their studies. The typical home offers greater independence and flexibility, while the private student home includes organized services and increased security.

Following is a table with indicative values of standard VS apartments VS Private Student Homes:

It is noteworthy that with a rent of around 500 – 550 euros/month, a student apartment is available at about 40sqm, when for organized private student homes the leased surface is reduced to half (20 sqm) as accounts are included, including accounts, public expenses and additional benefits.

PPP

The government under the PPP process (Public and Private Partnership) has decided to create new ones or the total renovation of existing student residences as well as with the entry of private universities will increase the existing problem of students’ housing.

However, although these PPPs are absolutely necessary, as securing a housing for students studying in another city from that of their origin is painful, there is no safe provision for when they will be put on implementation and then. The relevant procedures are delayed for many reasons, including:

- The well -known bureaucracy problem that has obstructing the construction industry,

- Universities’ inability to support them by not having technical services,

- The rapid increase in raw materials and energy costs.

Indicatively, the universities that have been in the competition process or are at a very initial stage are the University of Western Attica, the University of Western Macedonia (Kozani, Florina, Kastoria, Ptolemaida), the University of Crete (Rethymnon) (Volos and Lamia) et al.

The Panteion University has already assigned the renovation of a building, a former student home of the University, with a capacity of about 170 beds. Once these agreements are completed, it is estimated that they will be able to accommodate 8,000 students and, along with the investments of private companies, are expected to meet the needs of up to 100,000 students.

Studies in Greece

According to data published in its annual report by ETHAE (National Higher Education Authority) for the year 2022 – 2023, there are 25 higher education institutions in Greece with 423 departments. It has 614 undergraduate programs, 1,356 postgraduate and 422 doctoral.

The total of active students amounted to 483,438. Most of the student population was in the MSc (undergraduate program) with 361,888 (74.9%) students, in the MSc (Postgraduate Program) 89,075 (18.4%) students and finally in the DSF (6.7%).