The set of new support measures of housingwhich will apply from November 2025 and then presented today (8.9.25) Ministry FinancialKyriakos Pierrakakis, in the context of specialization of the measures announced yesterday (6.9.25), Prime Minister Kyriakos Mitsotakis from the TIF step.

Specifically, as the Ministry pointed out, in order to support housing, A main and student residence rent for 80% of tenants with income and property criteria (the measure has already been established) is returned annually. An annual cost of 230 million euros.

It is also expanding for 2026 the income tax exemption for 3 years for vacant homes (which remain closed at least 3 years) to be leased in long -term leasing by the end of 2026. The budgetary costs are estimated at € 13 million for 2026 and € 22 million for 2027.

Expands for another year, that is, by the end of 2026, the suspension of VAT on new buildings, with the aim of increasing houses to be disposed of at an annual cost of EUR 18 million.

The reducing income tax reduction for the costs of upgrading buildings for the years 2025 and 2026 (the measure has already been established) is extended. Estimated annual cost of € 5 million.

The restriction of new short -term leases in the three Municipal Districts in Athens is also expanding for 2026.

Target of its new institutional framework social consideration It is the utilization of public real estate through incentives that mobilize private initiative (eg acquisition of property ownership) for the construction of modern homes to meet citizens’ housing needs. In this way it is attempted to utilize public property by creating social housing and to secure social lease with the possibility of redemption in socially vulnerable groups.

From 2026 is reduced by 50% and by 2027 ENFIA is abolished for main houses in settlements with a population of up to 1,500 inhabitants. The measure is expected to strengthen the presence of residents in these areas. It is noted that decentralization is directly linked to the housing problem.

What changes in rent tax

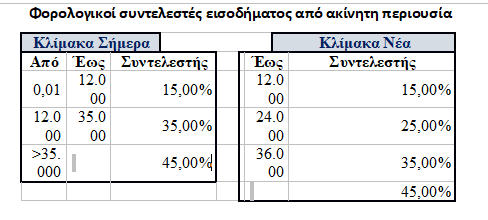

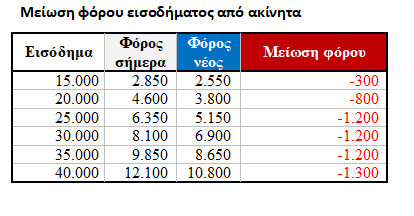

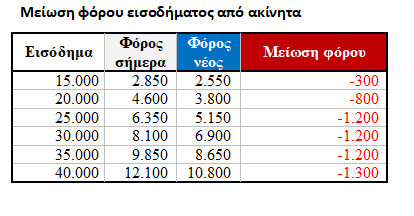

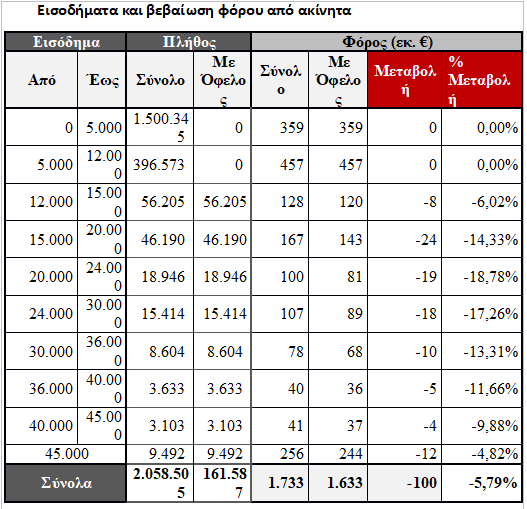

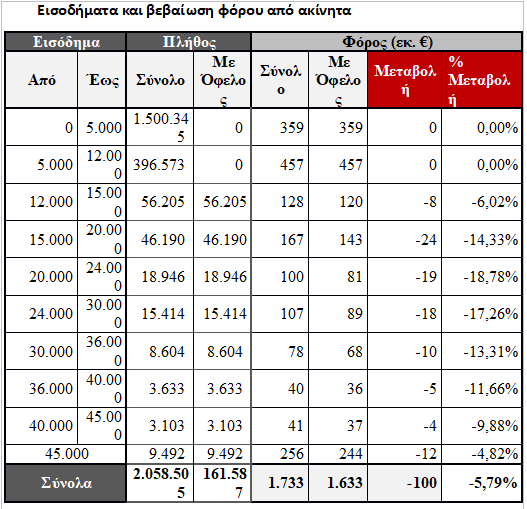

From the tax year 2026, a 25% intermediate rate has been established for rents from 12,000 to 24,000 euros. It is recalled that today up to 12,000 is applied 15% and then increases to 35%. Immediate beneficiaries are estimated at 161,587 property owners, but this measure is expected to work positively for tax compliance and rented rates. The budgetary costs are estimated at € 90 million a year that will be charged in 2027 and next.

Measures applied

A number of measures have been implemented in previous years to address the housing problem. Indicatively reported:

- Reduction of ENFIA by 34% average for natural persons. Cost of 860 million euros per year.

- Abolition of parental benefits tax for first-degree relatives, for donations of up to 800,000 euros, from October 1, 2021.

- VAT suspension in new buildings in the last 6 years 2020-2025. Financial costs: EUR 18 million per year.

- My home program with a low-profile mortgage for young people or pairs of 25-39 years for the purchase of a first home with a total budget of € 750 million from the Public Employment Service (DBA).

- Program “Save – Refurbish For Youth”, with a budget of EUR 300 million (200 million from recovery fund and 100 million from national resources). The “saving” section consists of providing incentives for energy -saving interventions in the household sector and the “renovation” part consists of providing incentives for aesthetic, functional renovation and upgrading of housing as complementary to energy saving interventions.

- Housing Subscription Program through the DBA, which utilizes private homes that were allocated to housing applicants for international protection under the Estia II program for housing vulnerable social groups.

- From 1/1/2024 a greater tax reduction for the costs of upgrading buildings (increase from 40% to 100%) was applied where the costs of buying goods are taken into account. Expenditure on the purchase of goods and receiving services associated with energy, functional and aesthetic upgrading of buildings, which have not already been integrated or incorporated into a building upgrade program, reduce, equal to a period of five (5) years, tax on taxation, tax on taxes, Sixteen thousand (16,000) euros.

- Program “Refrigerate-Democratic” for empty houses: To increase the useful houses, up to 40% of the cost of renovation and up to € 10,000 for vacant houses that will be rented in long-term lease with a budget of € 50 million.

- From 1/1/2024 with the aim of regulating the market for short -term leases and dealing with secondary negative impacts on rent prices, 13% VAT is imposed and finally in short -term real estate leases (Airbnb) on legal persons and more or more while the short -term lease was tightened.

- The criteria for Golden Visa have been touched by September 2024. Area of the property to be at least 120 sq.m. and concerns a unique property. In addition, in the rest of the regions, from 250,000 euros the limit increased to 400,000 euros.

In addition to the above measures the following new measures were implemented in 2025:

- My new home II program was created, with a total budget of 2 billion euros, of which 1 billion euros is funded by the loan side of the Recovery and Rules (TAA) and € 1 billion by banks. The interest rates is reduced by 50% from current commercial, as the amount funded by the TAA is interest -free. The age and income criteria are widening in relation to my first home program. The program covers natural persons and couples from 25 to 50 years old, with income from 10,000 to 20,000 euros for the unmarried, increasing to 28,000 euros for the couple now 4,000 euros for each child. The program is expected to cover more than 15,000 families. In addition, an additional “upgrade my house” program is implemented through the TAA’s loan side to upgrade old houses at zero interest rate.

Any owner who converts from 08/09/2024 and until 31/12/2025 blank property (which remains closed for at least 3 years) or a short -term lease, in a long -term lease, has an income tax exemption for that rent for 3 years. It concerns real estate up to 120 sq.m.

In downtown Athens and specifically in the 1st, 2nd and 3rd Municipal District, where the percentage of short -term apartments are particularly high, no new short -term lease is allowed for a year with the possibility of extension. Specifically from 1/1/2025 until the end of the year, a new property is not allowed in the AADE short lease register in these areas. - The end of climate crisis resistance for short -term leases from 0.5 to 1.5 euros per night in 2 euros during the winter months and 8 euros during the summer months has increased.

- The maximum subsidy of the program was doubled-I have been renovated from 4,000 to EUR 8,100: from 40% of costs up to 10,000 euros, the subsidy to 60% of costs up to 13,500 euros increased.