The annual update of analysts, which took place at the Institutional Investor Association, presented its activities and basic financial figures. Motor Oil for the use of 2024.

There was also a reference to the course of Motor Oil activities the current use of 2025.

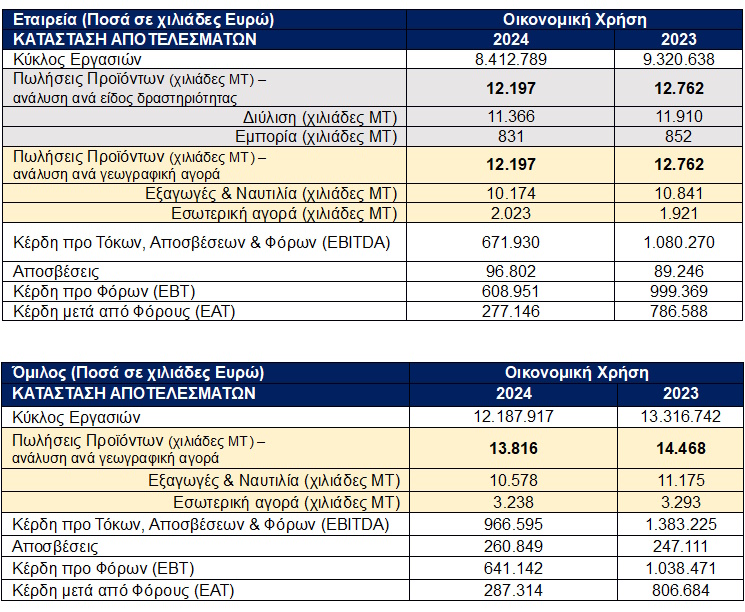

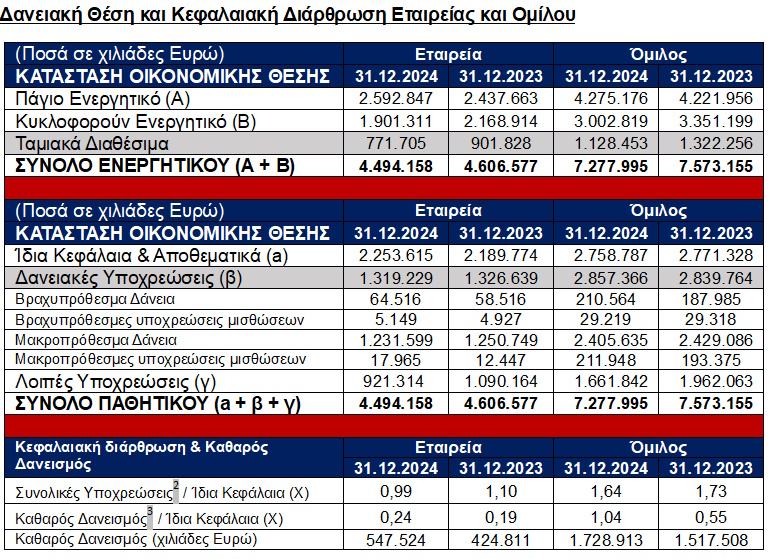

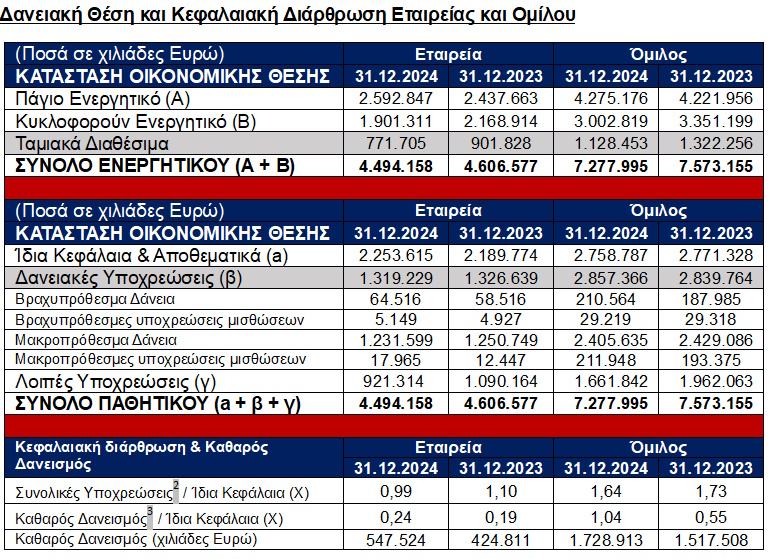

The basic financial sizes and sales of the products of the parent company and the MOTOR Group (HELLAS) SA. The use of 2024 compared to the use of 2023 were as follows:

Basic factors for shaping the financial sizes of company and group

Company

Reduction of turnover (by 9.74%) of 2024 versus 2023 is due to a reduction in sales volume by 4.63% (from 13,238 to MT 12,625) in conjunction with the reduction of the average oil prices (in US dollars) by about 5%. The average euro exchange rate against the US dollar formed the use of 2024 at almost 1.08 unchanged for the average equality of 2023.

The refinery product sales volume was formed at 12.197 in 2024 against 12,762 in 2023. Products were made in all three markets in which the company traditionally operates (internal, exports, shipping), confirming its export orientation given that overseas sales and sales of 80%.

It should be noted that the reduced sales volume of 2024 versus the year 2023 is due to the lower degree of availability (Utilization rate) of the Parent Refinery Units in the last quarter of 2024 due to the incident on 17.9.2024. In addition, a significant impact on the operational result of the company The use of 2024 was continuing to normalize the margins of basic refining products, compared to the historical high margins of 2022 and 2023, and the negative impact of stock assessment. Part of this effect was offset by Business Interruption Insurance Coverage.

As a consequence of the above, EBITDA’s pre -tax, interest profits (EBITDA) stood at EUR 671.9 million and pre -tax profits at 608.9 million euros.

The decline in parental pre -tax profitability in conjunction with the significant tax burden due to the imposition of the emergency solidarity levy passed by Law 5122/19.07.2024 reduced the net profitability of the company 2024 of the company which was EUR 27.1 million.

Group

The decrease in consolidated turnover (by 8.48%) of 2024 versus 2023 is due to the same parameters that have contributed to the formation of the parent’s turnover.

Consolidated profits before taxes, interest and depreciation (EBITDA) of 2024 stood at € 966.6 million.

The consolidated pre -tax profits stood the use of 2024 to EUR 641.1 million while consolidated profits after taxes were reduced to EUR 287.3 million due to the imposition of an emergency solidarity levy passed by Law 5122/19.07.2024.

Annual Analyst Update – April 2025

Investment expense

The company’s total investment expense of 2024 was € 196 million. The largest amounts of expenditure were:

- EUR 70.8 million in the construction project of the new Propylene Production Unit.

- EUR 29.8 million in the usual maintenance, upgrading and revamping work of the refinery units (including EUR 9.2 million which relates to the restoration work of the Argument Restoration Unit after the incident in the refinery at 17.09.2024).

- EUR 28.7 million in a series of lesser -scale projects with the aim of enhancing safety and hygiene, as well as improve the environmental terms of the refinery.

- EUR 28.6 million in the construction project of a new high performance power and heat unit of 57 MW.

- EUR 14.4 million in upgrading projects of the existing port of the refinery as well as the construction of a new pier in an area near the refinery.

- EUR 8.5 million in environmental projects to reduce the refinery’s carbon footprint, ensuring greater energy autonomy.

- EUR 6.9 million in projects for the production and transfer of alternative fuels such as hydrogen.

- EUR 3.5 million in new tanks construction projects.

The company’s total investment expenditure on 2025 is expected to remain at the level of EUR 200 million with most of it concerning:

- The rehabilitation work of the Argon Restoration Unit due to the incident that occurred on 17.9.2024,

- The completion of the work and the Commissioning of the new Propylene Production Unit and,

- The basic design and order of equipment and materials for the construction of the new electrolysis unit for hydrogen production.

Business Developments – Perspectives

Fuel industry

A key priority for the use of 2025 is the completion of the work to complete the operation of the Crude Petroleum Refine Unit (CDU). These work is expected to be completed within the third quarter of 2025 and during their implementation the production capacity of the company’s refinery is expected to range between 65% – 80% of its total nominal potential as it is formed by arrival and crude oil and alterations.

The lower grade to work in the refinery units combined with the continuing normalization of refinement margins, compared to the historical high margins of 2022 and 2023, is expected to impact restrictively on the EBITDA of the first semester 2025. Part of the lower employment effect will be offset by Business Interruption Insurance Coverage.

Circular economy

In January 2025, MOTOR OIL (HELLAS) SA, through the 100% subsidiary company Manetial Limited, completed the acquisition of 94.44% of the company’s share capital under the name Elector Company. The above transaction had been approved by the decision of the Extraordinary General Meeting of MOTOR OIL (HELLAS) SA.

With the above acquisition, the Group consolidates its position in the circular economy sector in which it is already active through LPC, Verd and THIS Environmental Services.

Electricity industry

In December 2024, the test of the 877 MW of the Komotini Thermoelectric SA began the test operation of the Gasinatroobilic Station. In the share capital of which MOTOR OIL (HELLAS) SA It participates with 50%. The commercial operation of the unit is expected within 2025.

Dividend

The dividend distribution proposal always constitutes an act of balance for companies as administrations must take into account financial performance of previous years, current economic conditions, as well as investments implemented or possibly undertaken in the near future.

The management of the company consistent in its policy of maximizing the dividend performance of its shareholders will propose to the upcoming Annual Ordinary General Meeting the distribution of a total dividend for the use of EUR 1.40 per share. It is noted that it has already been paid and recognized as a use of 2024 € 0.30 per share whose payment was made on 3.1.2025 and therefore the remainder of 2024 dividend will be EUR 1.10 per share.

The proposed total dividend amount per share for the use of 2024 corresponds to a dividend yield of 6.78% based on the company’s share price at 31.12.2024. Taking into account the above proposed dividend amount for the use of 2024, MOTOR OIL (HELLAS) SA From the import of its shares on the Athens Stock Exchange in 2001, it will have distributed through money distributions in the form of temporary dividends, dividends and refunds the total amount of EUR 19.73/share, which corresponds to an average dividend yield of 6.24%.