The government brings from 2026 scale reform income tax With double targeting, the middle -class relief (employees, retirees, freelancers) and the strongest support in families With children and young people, as provided by TIF announcements, with the benefit of up to 5,300 euros on a case -by -case basis.

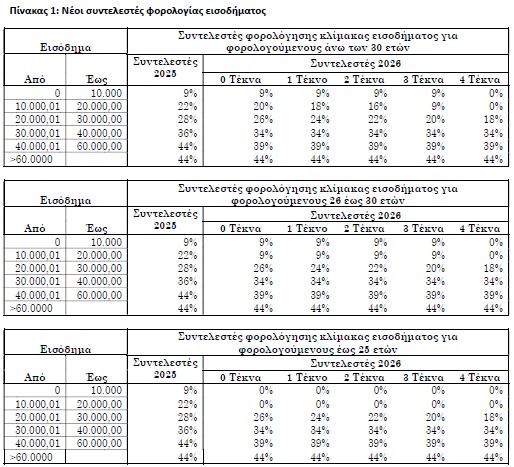

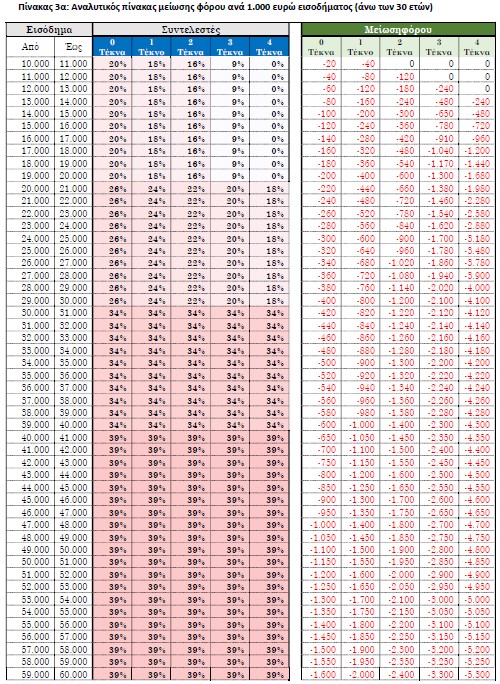

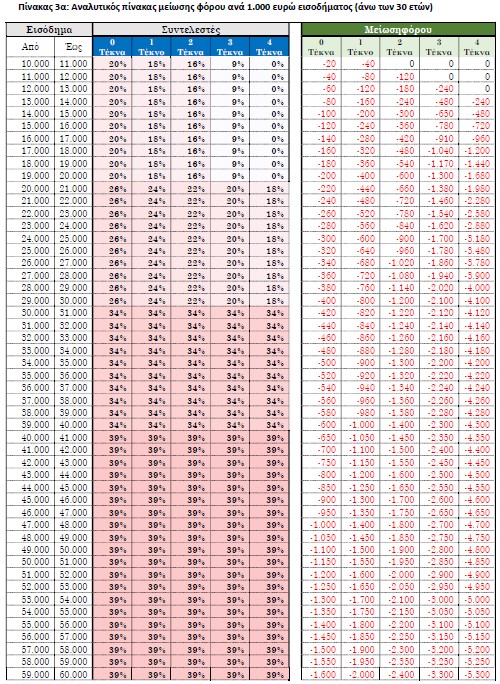

The rates on the middle scales of income tax decrease by 2 points (10,000–20,000 in 20%, 20,000–30,000 to 26%, 30,000–40,000 to 34%), an intermediate rate of 39%for 40,000–60,000 euros is introduced and the maximum 44%remains for the section of over 60,000 euros. The regulation also incorporates a demographic dimension with additional premiums with families with children. In the range of 10,000–20,000 euros the rate becomes 20% for those who do not have children, 18% with one child, 16% to two, 9% to three and 0% for four or more. On the scale of 20,000–30,000 euros the rate is reduced by 2 points per child (26%, 24%, 22%, 20%, 18%). The scales 30,000–40,000, 40,000–60,000 and over 60,000 are the same for everyone (34%, 39%, 44%). Based on the above, a Case of an employee with an income of 60,000 euros and 4 children, leads to a tax reduction of 5,300 euros!

Special status is also provided for young people. Up to 25 years old, the rates are reset in the range of 0–20,000 euros. For ages 26-30, the rate of 10,000–20,000 euros is limited to 9% (0–10,000 remains 9%), while the other scales are the same as over 30.

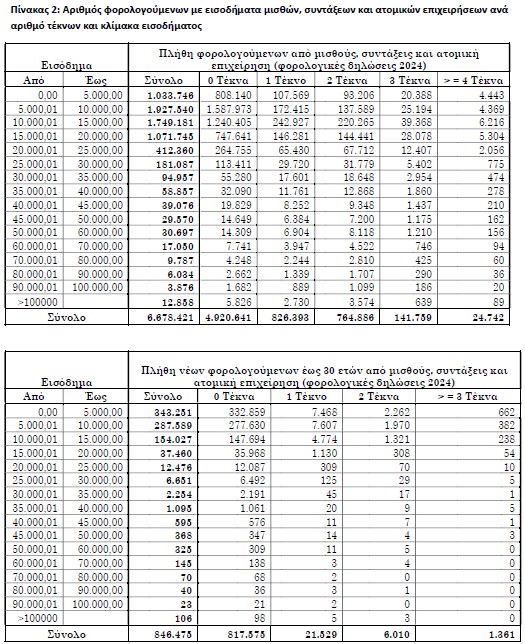

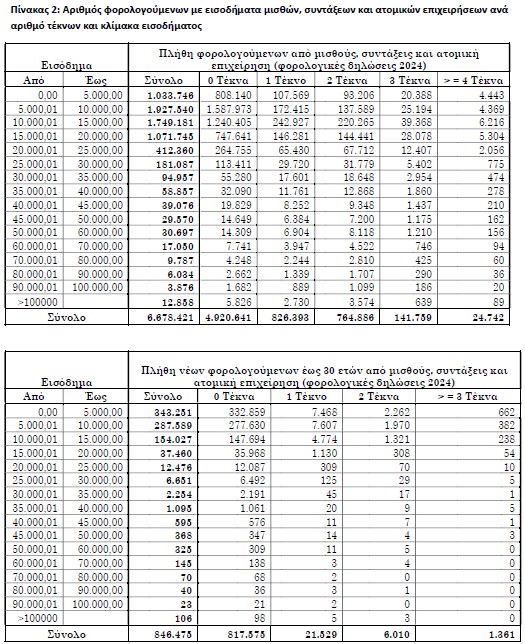

Application begins with January 2026 withholding for employees and retirees, while individual businesses/farmers will see the benefit with the statements of 2027. It is estimated that about 4 million taxpayers are benefited.

It should be noted that The indirect tax -free also goes up. Indicatively, for over 30 years of age, there is about 8,633 euros without children, 10,000 with one child, 11,375 with two, 14,364 with three and 27,100 with four children, while for up to 25 years the threshold reaches 22,200 euros without children, which explains why the tax is virtually zero up to € 20,000.

Here are examples of how the tax is now shaped and what the benefit is on a case -by -case basis:

Over 30 years of age, with no children

- Income 20,000 euros: Tax before 2,483 euros, after 2,283 euros. Benefits of 200 euros.

- Income 30,000 euros: Tax before 5,483 euros, after 5,083 euros. Benefits of 400 euros.

- Income 50,000 euros: Tax before 13,883 euros, after 12,783 euros. Benefits of 1,100 euros.

Over 30 years of age, a child

- Income 20,000 euros: Tax before 2,360 euros, after 1,960 euros. Benefits of 400 euros.

- Income EUR 35,000: Tax before EUR 7,260, after 6,360 euros. Benefits of 900 euros.

- Income 50,000 euros: Tax before 13,760 euros, after 12,260 euros. Benefits of 1,500 euros.

Over 30 years old, two children

- Income 25,000 euros: Tax before 3,640 euros, after 2,740 euros. Benefits of 900 euros.

- Income 30,000 euros: Tax ago 5,140 euros, after 3,940 euros. Benefits of 1,200 euros.

- Income 60,000 euros: Tax 18,140 euros before, after 15,740 euros. Benefits of 2,400 euros.

Over 30 years of age, three children

- Income 20,000 euros: Tax before 1,920 euros, after 620 euros. Benefits of 1,300 euros.

- Income EUR 35,000: Tax before 6,820 euros, after 4,620 euros. Benefits of 2,200 euros.

- Income EUR 50,000: Tax before 13,320 euros, after 10,520 euros. Benefits of 2,800 euros.

Over 30 years of age, four children

- Income 20,000 euros: Tax before 1,680 euros, after 0 euros (zero up to 20,000). Benefits of 1,680 euros.

- Income 30,000 euros: Tax before 4,680 euros, after 580 euros. Benefits of 4,100 euros.

- Income 60,000 euros: Tax of 17,680 euros, after 12,380 euros. Benefits of 5,300 euros.

Young 26–30 years old, no children

- Income 20,000 euros: Tax before 2,483 euros, after EUR 1,183 (9% to 10–20,000). Benefits of 1,300 euros.

- Income 30,000 euros: Tax before 5,483 euros, after 3,983 euros. Benefits of 1,500 euros.

- Income 50,000 euros: Tax before 13,883 euros, after EUR 11,683. Benefits of 2,200 euros.

Young 26–30 years old, with children

- With 1 child, income of 20,000 euros: Tax before 2,360 euros, after 1,060 euros. Benefits of 1,300 euros.

- With 1 child, income of 35,000 euros: Tax before 7,260 euros, after 5,460 euros. Benefits of 1,800 euros.

- With 2 children, income of 25,000 euros: Tax before 3,640 euros, after 2,040 euros. Benefit of 1,600 euros

Young up to 25 years old, no children

- Income 15,000 euros: Tax before 1,283 euros, after 0 euros. Benefits of 1,283 euros.

- Income 20,000 euros: Tax before 2,483 euros, after 0 euros. Benefits of 2,483 euros.

- Income 30,000 euros: Tax before 5,483 euros, after EUR 2,183. Benefits of 3,300 euros.

The conclusion is that the horizontal -2% at 10,000–40,000 euros yields small but universal reliefs for those who do not have children, while targeted premium enhances significantly three -year -old families and up to 30 years of age.