Strong financial performance, profitability and rise to all financial sizes are presented by IDEAL Holdings For the first half of 2025.

The results announced today (4.9.2025) reflect the organic growth of existing investment and enhanced dynamics after adding new investments to its portfolio. At the same time, the positive assessment of Ideal Holdings’ strategy by the investment public during the same period reflects the successful course, the continued creation of investment value and the long -term perspective.

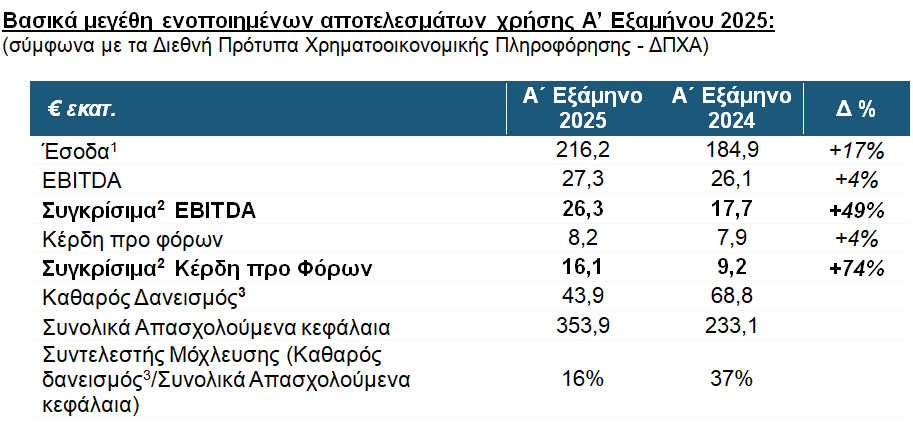

Main Economic Sizes of the first semester 2025:

- Consolidated sales increased by 17% and stood at € 216.2 million.

- Comparable earnings before tax, interest and depreciation (EBITDA) amounted to € 26.3 million, up 49%.

- Comparable pre -tax profits (EBT) stood at € 16.1 million, up 74%.

- Its financial position was reinforced by a 36.2% reduction in net lending to € 43.9 million, confirming Ideal Holdings’ dynamics for new development initiatives.

- Overall, the financial figures in all companies have risen.

The main business, financial and investment developments of first semester:

- Complete one of the largest acquisitions that have taken place in recent years in the Greek food market with the acquisition of Barba Stathis.

- Successful completion of the share capital growth by over -disclosure of public offering by 2.6x.

- Complete the Oak Hill Advisors (OHA) agreement and the first investment of € 61.5 million.

- Reward of shareholders with a refund totaling € 0.40/ share (6.7%yield).

Positive performance and prospects for Ideal Holdings Investments

1. Fixed Development in the Specialized Retail Branch (ATTICA Department stores)

The Ideal Holdings specialized retail sector is being developed at a steady pace. In particular, in the first half of 2025, Attica department stores recorded a 4% revenue increase, to € 106.3 million. Comparable EBITDA increased by 5% to € 11.8 million, while comparable earnings before tax (EBT) rose 12% and stood at € 8.5 million.

Natural stores welcomed 3.2 million visitors and, despite geopolitical challenges, was significantly enhanced by third -country travelers, with tax free sales moving at a 9%growth rate.

The online store (Attica Eshop) increased by 38% in the context of continuous growth and enlargement of the online product range with more than 1 million products, 1,000 brands, 45,000 codes and 11.4 million visitors per year.

2. Enhanced profitability and important projects in the IT sector (Byte, Adacom, Bluestream and subsidiaries)

The Ideal Holdings IT industry has recorded a significant improvement in comparable sizes and especially in profitability. Comparable EBITDA amounted to € 8.5 million, increased by 25%, while comparable before tax (EBT) increased by 26% to € 7.3 million. It is noted that the EBITDA margin stood at 15% from 10%, as a result of the focus strategy in higher added projects. Revenue stood at € 57.1 million reduced by 12%, mainly due to the completion of large IT infrastructure projects, lower profitability and high funding needs in the corresponding semester of 2024. The unexplained project balance at the end of the first half of the first half of the semester is € 78 million.

In addition, within the first half, important projects were implemented in private and public bodies, while new contracts were made as a result of increased demand for services provided by IDEAL HOLDINGS investments in the IT sector (acceleration of digital transformation, protection against cyberattacks, compliance with European regulations).

3. Dominant position and innovation in the Food Branch (Barba Station and Halvatzis)

The food industry was recorded in the first half of 2025, confirming its durability and flexibility in an environment of constantly challenges and changing consumer habits.

Specifically, the proceeds amounted to € 64.3 million, increasing a 6%increase of 1 compared to the corresponding period last year, which is the highest performance of the last five years for a corresponding period. Comparable EBITDA stood at € 6.8 million, up 7%. Comparable pre -tax profits (EBT) rose 88% and stood at € 4.0 million thanks to increased operating profitability, as well as reducing lending and borrowing costs compared to the corresponding period last year.

Barba Stathis maintained its top position in the market for branded frozen vegetables and reinforced the market share in branded fresh salads. Halvatzis, taking advantage of synergies with Barba Station at distribution and sales level, rose, and B2B exports and sales were particularly positive.

Overall, the strategic planning of IDEAL Holdings for the Food Sector focuses on increasing sales and operating profitability with the main focus on maintaining and empowering market leadership positions with high quality products, further highlighting innovative products (360 PLANT BASED MEAL and select) through targeted investments in productive and storage units.