OR auction state -of -year bonder Japan has noted the lowest demand since 2009, amid growing speculations that the Central Bank will increase interest rates since October.

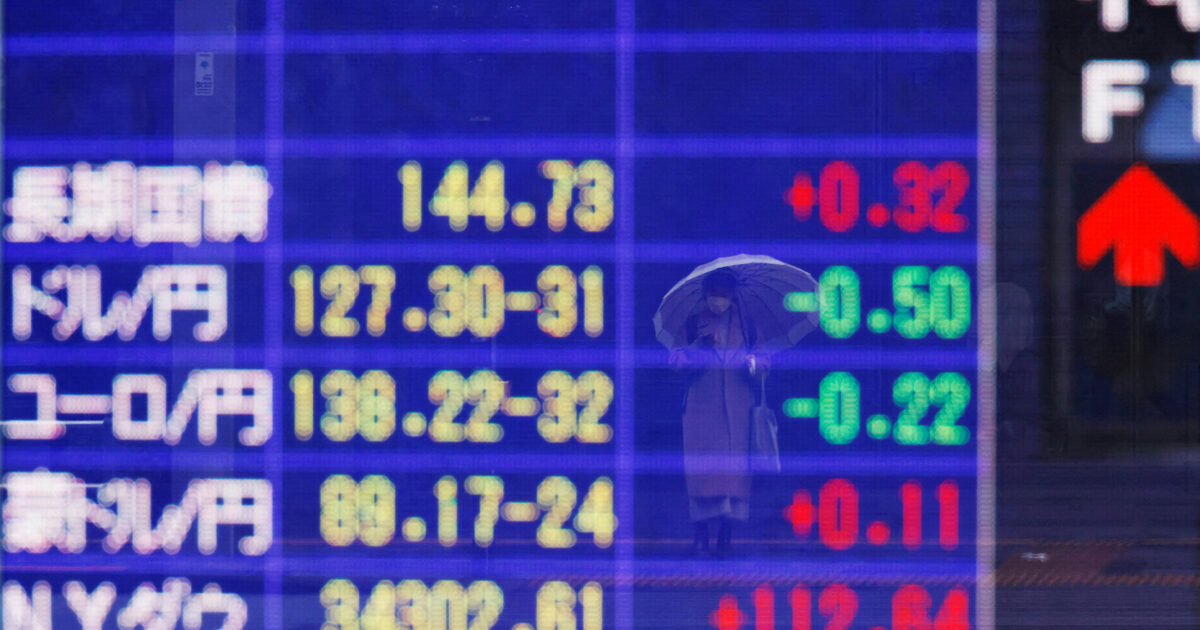

The supply index to cover, a key indicator of demand, fell to 2.81 from the previous auction. It was significantly lower than the 12 -month average, which was 3.79. Two -year bonds continued their decline, leading to a rise of 1 base unit to 0.935%, the highest level since 2008.

Investors are watching with great care the vote for the leadership of the ruling Liberal Democratic Party on October 4, to determine whether it will affect expectations for the next increase in interest rates by the Bank of Japan, as many in the market are afraid that one may be afraid of one.

The performance of two -year bonds, which is sensitive to monetary policy expectations, has increased by about 10 basis points since Prime Minister Shigeru Ishiba has announced his resignation.

“The auction had weak results due to increasing expectations to raise interest rates by the Bank of Japan in October, as well as the cautious investor at the end of the quarter,” said Miki Den, a senior strategic interest rate analyst at SMBC Nikko Securities.

At the last meeting of the Bank of Japan, two members of the Board of Directors disagreed with the decision to maintain interest rates steadily, reinforcing speculation that the bank is approaching the next increase. Boj’s board member Asahi Noguchi said in a speech yesterday (29.9.2025) that the need to adjust the policy interest rate is increasing.

The Central Bank has left a great deal of room for raising interest rates in the near future in a summary of comments from its meeting this month, without giving a clear indication that it will increase in October. Expectations to raise interest rates next month increased, with the overnight index swaps showing a chance of 67%.