High increase in new lending and increasing the contribution of supplies to total revenue, which resulted in the retention of falling interest rates. incomepresented in the first quarter 2025 or Piraeus Bankby achieving or exceeding all the goals of the administration.

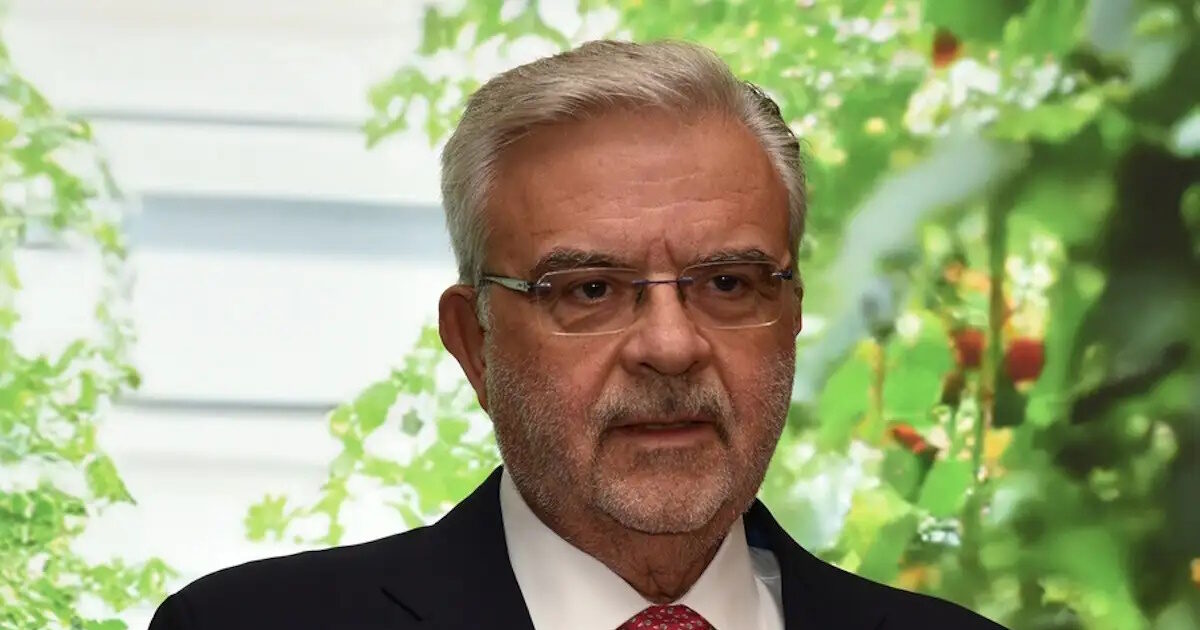

According to analysts by Piraeus Bank CEO, Christos Megalou, during the presentation of quarter results, due to the ECB’s interest rates, Piraeus’s interest rates were down 7% (net interest revenue declined to € 481 million).

Piraeus’s current case is for 3 months Euribor at 2.15% for this year, from 2.30% before, with no expectations to reduce ECB interest rates below 2%. This case, along with the renewed estimates of the development of lending, bonds and deposits, confirms the provision made by the Bank’s management for net interest rates of approximately 1.9 billion. euro in 2025.

The slight reduction in interest revenue was achieved due to the high increase in the bank’s loan volume. As the administration noted, Piraeus has increased its loans by 5 billion euros in five quarters (+1.1 billion euros in the first quarter of 2025, increased by 16% per year), while for the whole year it expects the target for a net credit expansion of € 2.6 billion.

The net credit expansion came from businesses, with manufacturing and construction/real estate sectors holding the largest share. As mentioned, out of € 3.2 billion in loan disbursements in the first quarter (repayments of $ 2 billion), 1.9 billion was channeled to large companies, 1.1 billion in small and medium -sized enterprises and 0.2 billion to individuals. Piraeus loans in projects on the recovery and durability Fund (TAA) stood at around € 2.2 billion from 2023, supplying 7 billion investments.

Contributing to the revenue of the decline in interest rates also had supplies. The bank’s differentiated model results in results, as, as the administration said, net procurement revenue as a percentage of net revenue was raised to 25%, while the medium -term target is to increase to 30%.

Net procurement revenue increased to EUR 160 million in the first quarter 2025 (145 million in the first quarter 2024, + 10% on a yearly basis), mainly driven by funding supplies, banking products, customer capital management and rental revenue. On a quarterly basis, however, net supply revenue declined by 5% (quarter of 2024: 167 million euros), due to recent government government measures, which mainly affected capital transport and payment supplies.

It is recalled that the General Assembly of Piraeus shareholders approved on April 14 the distribution to shareholders of 50% of the profits of 2024 (a total of EUR 373 million or EUR 0.298 per share). The dividend will be paid on June 10, 2025.