Positive sign and increase in values plot It is also noted in 2025, as in all five areas of study in the Attica Basin is recorded for the 7th consecutive year increase in potential price Sale, according to the Geoaxis Apartment Observatory.

The increase was measured on average at 5.60% compared to 2024 and 15.06% compared to 2023, revealing the dynamics of the market. In the decade, the values of the plots are at the highest point as an average increase of 40.25%is recorded.

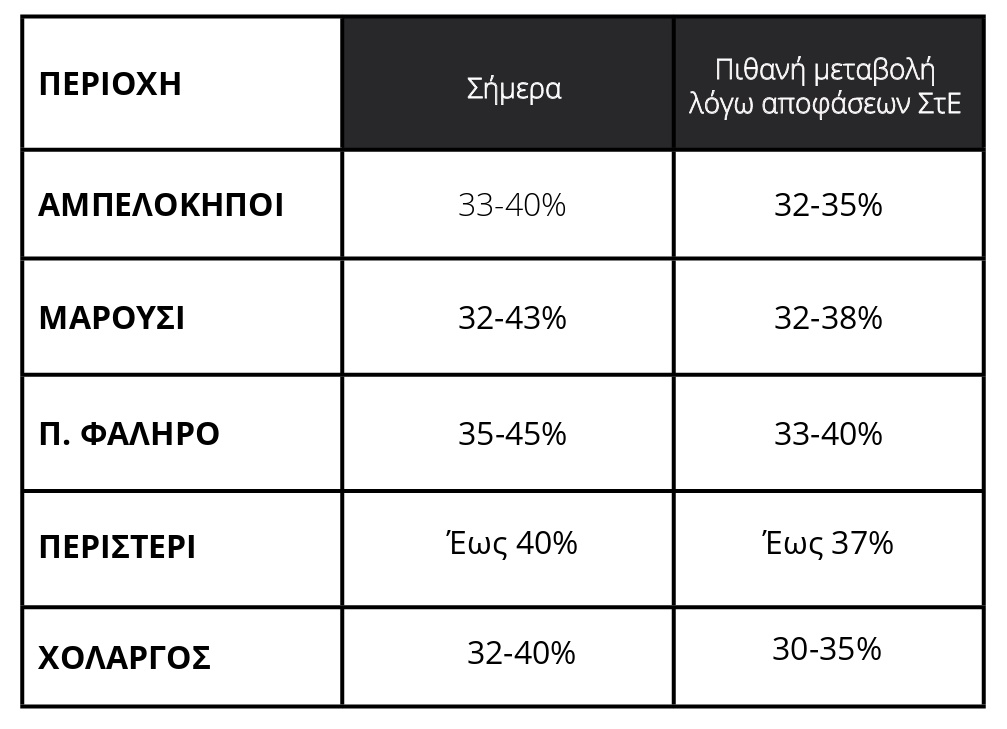

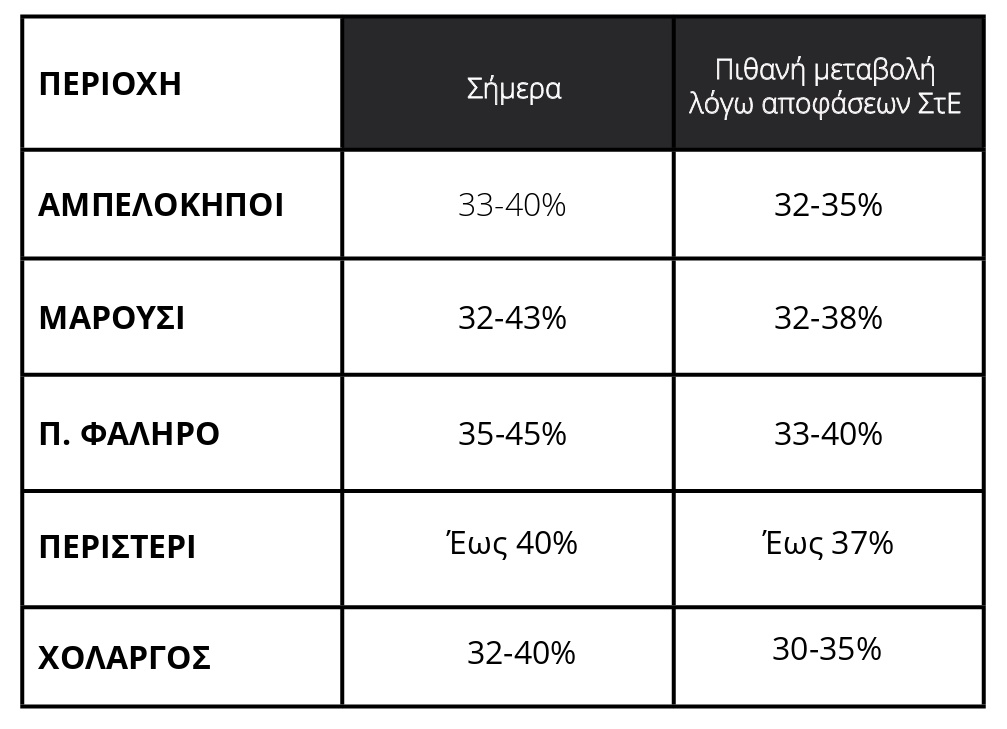

The processing of the data shows that, unlike other categories of property, the plots show a remarkable stability in both the decline phase and the rise phase. The tendency of 10 years clearly shows that we are in the upward phase of the cycle, perhaps near a new climax. Characteristic is the table below:

The values of the plots are at the highest level of the decade after an increase in demanded sales prices in an average of 40.25% compared to 2016 for five local markets. The largest increase in the requested prices (46.02%) recorded plots with SD. 3.6 In the Municipality of Athens Ambelokipi area and the smallest increase in plots with SD 1.8 in Peristeri (35.43%).

Regarding the considerations, the CoE’s decisions have freely frozen agreements that have been closed for months, with the market awaiting compression of up to 5% in the future rates if the bonus system does not come back.

The CoE, with its decisions, tightened the implementation of the NOK, raising serious legal issues that focus on the real environmental footprint and not just on the arithmetic restrictions in order to change the philosophy in design and compatibility with urban planning tools (ICS).

The impact on the building and real estate industry in general cause uncertainty to individuals, engineers, manufacturers and institutional investors, especially in high -value areas (eg Athens, tourist areas), where the building bonus determines the performance of an investment. Following collecting data from contractors and real estate agents held during the Observatory, the picture of the compensation rates in Attica is as follows:

However, the cycle of high building activity that has been opened after 2018 continues, though with a decreasing intensity, as the demand for unstructured land and/or land with old buildings for the construction of newly built apartments is blooming. Basic causes that feed existing demand can be sought:

- In accumulated housing requests not satisfied due to financial crisis in the last fifteen years

- In the immediate disposal of capital (high liquidity) alongside the existence of undeclared income from the middle class

- In the new reality for work from home

- In the quality and technological depreciation of a large number of constructions before 1980

- In the integration of apartments into investment products

- The ability to achieve yields through short -term lease and

- At the disposal for investment risk spread, through real estate buying.

At the same time, the negotiation between contractors and land owners is becoming tougher as the increase in apartment selling prices is offset by increasing the cost of construction and funding. Today an average borrowing rate is in the range of 5.0-1 5.5%. According to ELSTAT, the cost of raw materials for new constructions is reflected in the prices of new buildings. The average index of April 2024 – March 2025, compared to the corresponding index of April 2023 – March 2024, increased 5.1%, compared to a 6.6% increase in comparison of the corresponding previous twelfths.