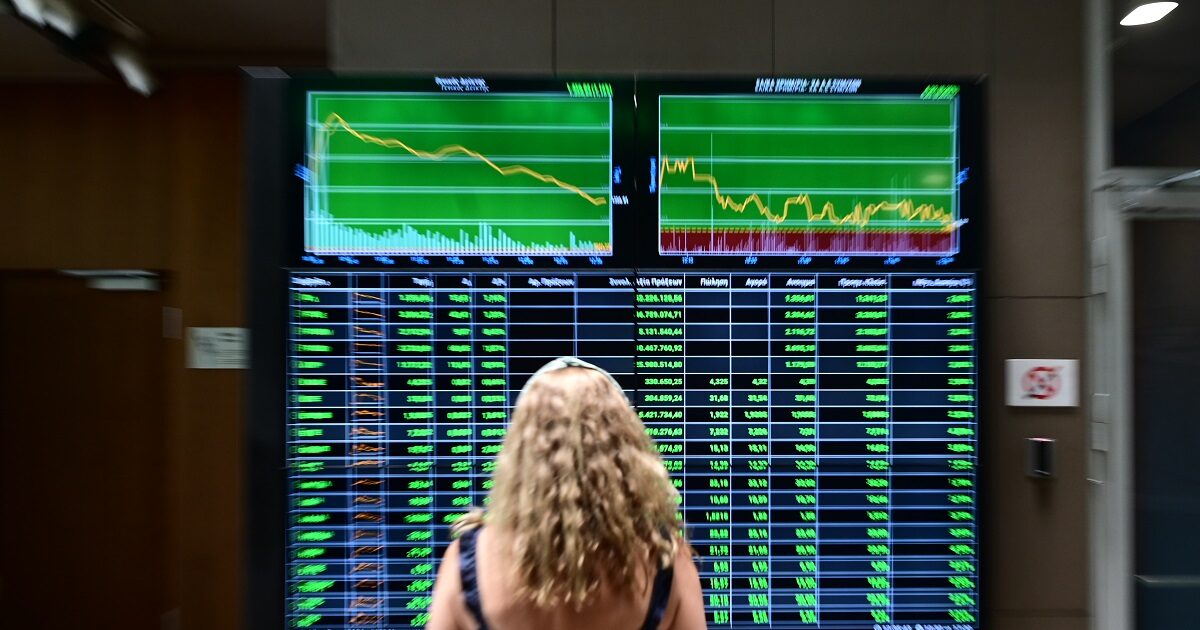

The recovery of the Greek economy after the crisis of the previous decade and the rise of the Athens Stock Exchange, where the General Index has now exceeded 2,100 points while during the Memorandums had repeatedly retired to 500, he points out in a statement. Forbes.

Forbes’s financial and business magazine points out that in recent years “the ratio of debt to GDP has improved from 200% to about 153%, unemployment fell to 7.9% and the European Commission provides for a growth of 2.3% for 2025, clearly higher than the eurozone average”.

This success was based on “additional revenue and reforms that had a substantial impact”, with Forbes standing on “rapid digitization of public services” and the introduction of electronic issuance and booking systems, noting that thanks to such initiatives.

At the same time, strategic moves such as the concession of 14 regional airports “attracted foreign investment and upgraded infrastructures”, stimulating tourism after the pandemic contributed to growth, while reforms allowed shrinking the volume of red loans to 49% of red loans.

At the same time, the report stresses that today Greece finds better borrowing interest rates in markets From the United States and comparable to those of France, while during the crisis the cost of exit the bond markets was difficult.

The positive course of the economy is reflected in steady rise of the stock marketas, despite the radical changes in world trade and homes of geopolitical uncertainty, the power of the DG has been subdued over the last five years.

Forbes also notes that in the individual MSCI index, which includes listed companies of large and medium -sized capitalization, the performance of the Greek market is more than twice as much as the corresponding European and parasite better than the US index S&P 500.