The European stock markets were closed strongly lower on Friday (04.04.2025), with investors still upset by US scale dictatorial announced this week.

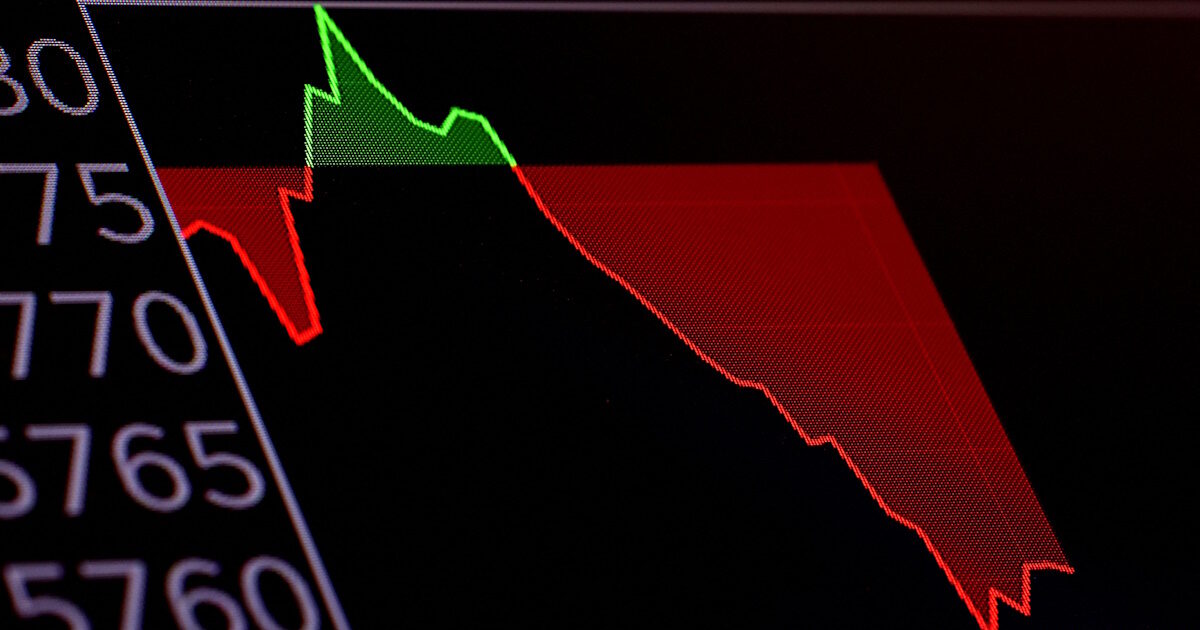

The Pan -European Stoxx 600 index which is average for European stock markets closed with a 5% drop inmarking the worst weekly loss of the year due to US duties’ announcements on Wednesday, declining 8.3% compared to last week.

The British FTSE 100 fell nearly 5%, the German DAX lost 4.7%or 1,100 points, and the French CAC 40 slipped by 4.3%. The Milan Stock Exchange slid up with 6.53% while Ibex 35 in Madrid fell 5.77%.

Banks lost 8.5% after Thursday’s fall by 5.53%. The industry is considered vulnerable to a slowdown in growth or in a recession, which is now considered a much stronger chance for both the US and the world economy. Bank of America strategic analysts said Friday that banks’ shares are also “among the assets that are less advanced in pricing on global macroeconomic problems”.

China, which has been affected by a total of 54% of the US, said on Friday that it will retaliate 34% in all US imported goods, starting on April 10.

The Stoxx 600 closed 2.57% lower on Thursday, as people digested the abrupt duties imposed by Trump in more than 180 countries, echoing fears of a world trade war and a recession in the US.

Among the most affected sectors on Thursday was retail, with Stoxx Luxury 10 falling 5.2% to the worst meeting of almost four years. The shares of Maersk and Hapag-Lloyd maritime giants, which are flags for the health of the global economy, have both retreated more than 9%.