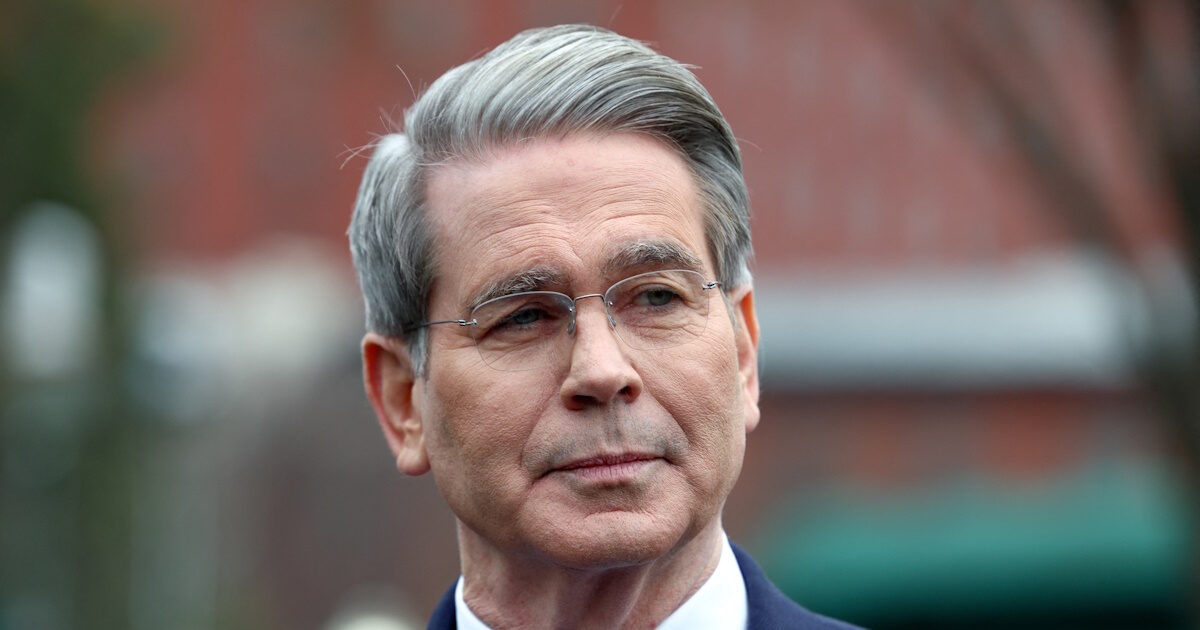

The management team debt of the Minister of Finance USA Scott Bessed is expected to maintain the ministry’s plans for longer sales of longer duration, especially after recent fluctuations in the 29 trillion market. dollars.

Although he had criticized Janet Gellen’s predecessor for the inclination of US debt to short -term government bonds, Bessed has since assumed his duties in January that the ministry was “far” far from replacing them.

Consequently, Wall Street does not expect any changes to Wednesday’s announcement (30.4.2025) for the projected auction sizes for the May – July quarter. The sharp increases in the long -term public returns for decades, earlier this month, only increased the stakes for Bessed, who has reset the goal of suppressing long -term returns.

The quarterly announcement of the offer is traditionally used to convey directions on how the auction sizes are likely to evolve. “Given the volatility of the public market, Bessed will be very careful about how he communicates any changes – especially in the sizes of coupons,” Subadra Ratzapa, head of the US interest rate strategy in Societe Generale, said in a telephone interview.

The latest announcement on February 5 – Besed’s first term – maintained the guidance of the era of Gellen, predicting Fixed sizes of auction of bonds and bonds “At least for the next quarters”. A spokesman for the finance ministry did not respond to a request for commenting on the ministry’s issuance plans on Friday.

Based on the historical pattern, Wednesday’s announcement will determine the magnitude of the so -called quarterly auction of next week’s return, which include expirations of 3, 10 and 30 years. It will also foresee the sizes for all other auctions of bonds and bonds by the end of July.

If no changes are made, next week’s auctions will amount to $ 125 billion and include:

- $ 58 billion of 3 -year bonds on May 5

- $ 42 billion of 10 -year bonds on 6 May

- $ 25 billion of 30 -year -old bonds on May 8

Debt limits

The federal debt threshold further restricts the Ministry of Finance from changing its course. Staying below the debt ceiling until Congress increases or suspended it has requested that the government reduce the bill of exchange, which expire over up to one year, and to reduce its cash balance.

When possible, Banking offers will be increased to replenish the cash stock. The Treasury may choose to provide instructions in Wednesday’s announcement on the debt threshold, including an assessment of when its resources will be exhausted without increasing or suspension.

Wall Street estimates fall under the August -October window of the government’s financial needs and the cash balance until September. The offering of state secrets became an ignition point during the 2024 presidential election, when Republicans, including Bessed, accused Gellen of restricting longer debt sales to suppress the basic interest rates on the market and support the economy in the November.

Bill bills as a percentage of outstanding debt increased, exceeding 15% to 20% previously set up by the State Lending Advisory Committee, which consists of investors, traders and other market participants. But both TBAC and Gellen and her team reacted to criticism.

While the auction sizes for some public titles – especially for seven years and 20 years – are far from the maximum levels achieved in 2021, others are in record levelsincluding of 10 years Reference Title. Increases could cause yields rising while Bessed from taking over his duties has stated that the administration wants to fall.

At the end of Friday, 10 -year yield was about 4.24%, more than a quarter of the percentage point higher than that of 12 months. Fell below 4% in early April for the first time since Octoberafter the government presented a duty of duty that is considered harmful to the economy. The subsequent recovery – despite the persistent weakness of US shares – suggested that investors no longer considered state bonds to refuge.

Forecasts for continued major US fiscal deficits in the coming years explain why many negotiators expect potential increases in the sizes of state bonds. Meanwhile, the rapid development of Stablecoins, a variety of cryptocurrencies with US dollar values, can support higher levels of issuance of grammar bonuses, some public observers say.

The Ministry of Finance’s quarterly survey of negotiators, in the context of Wednesday’s preparation, asked the demand for government securities as a reserve asset for Stablecoins. JPMorgan estimated that $ 114 billion in public bills supported Stablecoins at the end of last year, less than 2% of 6 trillion. pending dollars.

However, “the rapid development of the Stablecoin industry” means that it could become an “important player” in money markets, TD Securities’ strategic analysts, led by Gennadiy Goldberg, said in a note. If there is no change in instructions on Wednesday, “we believe that markets will interpret this as that the Treasury is willing to rely more on bold bills”, with a positive impact on longer duration titles, they wrote.