In the specialization of new scales taxation Income for employees, pensioners, professionals and farmers today (8.9.25) the Minister of National Economy and Finance, Kyriakos Pierrakakis, followed by the Prime Minister’s announcements by Kyriakos Mitsotakis from his step TIF On Saturday, September 6, 2025.

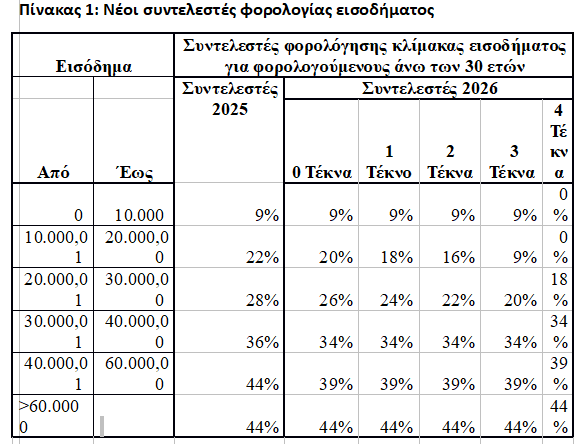

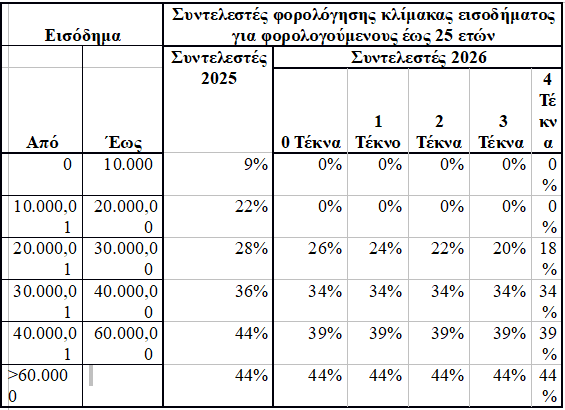

A key feature of the changes in the TIF announcements is the horizontal reduction by 2 percentage points of the tax rates of the tax from 10,000 euros to 40,000 euros.

General tax interventions, as presented by the Ministry of Finance, are as follows:

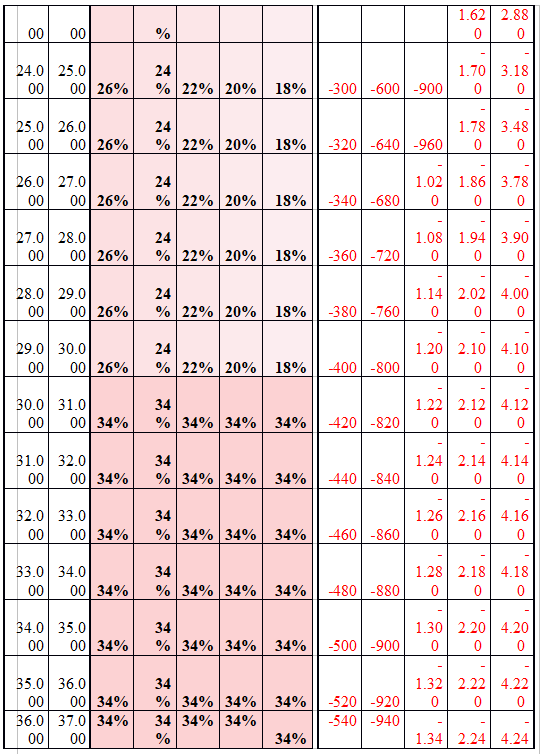

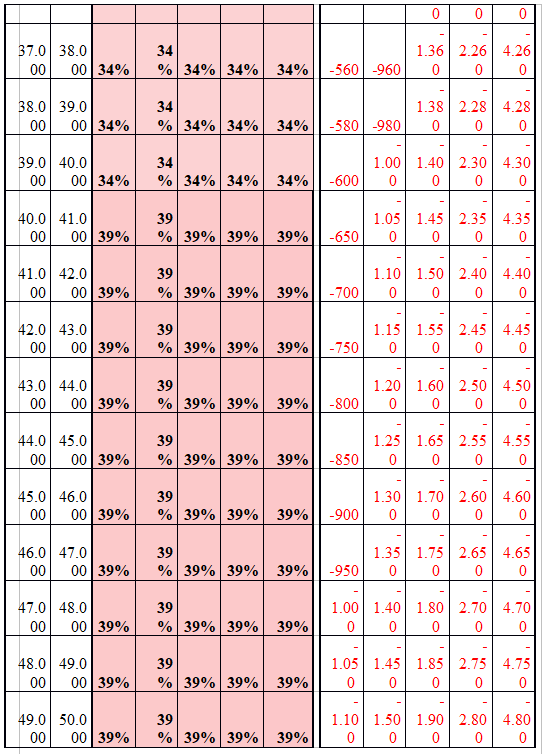

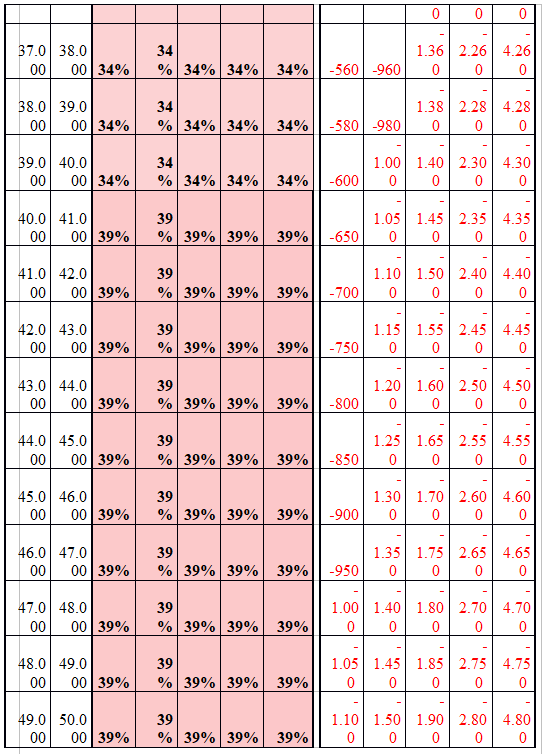

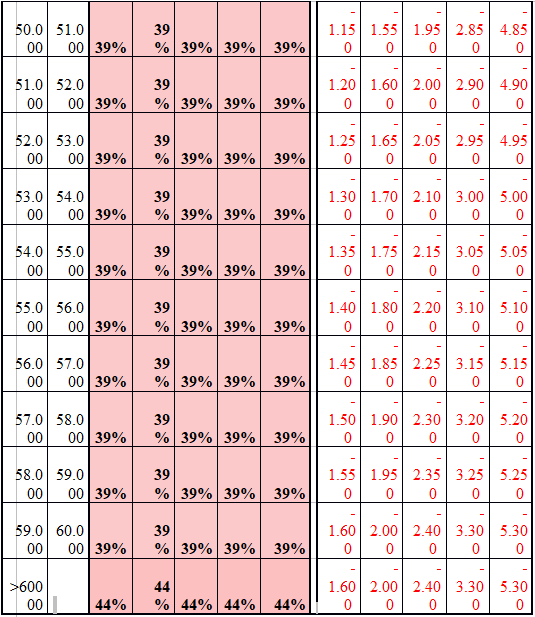

2% reduce scale rates from 10,000 to 40,000 euros:

- For 10,000 to 20,000 euros from 22% to 20%

- For 20,000 to 30,000 euros from 28% to 26%

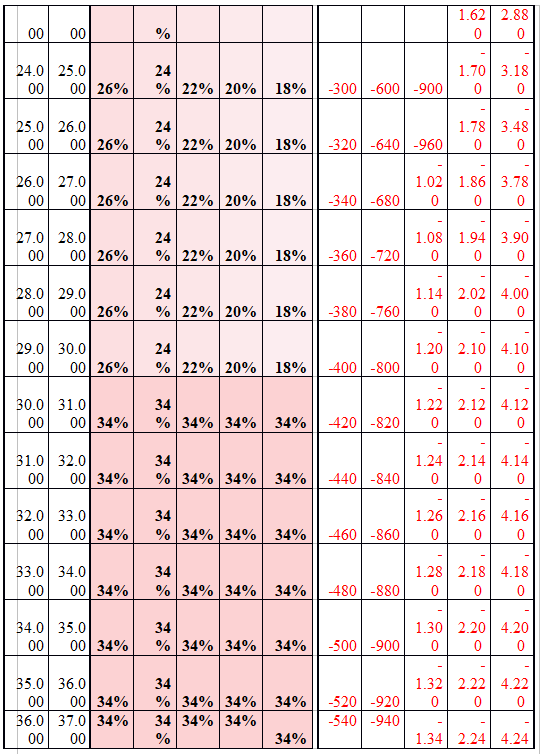

- For 30,000 to 40,000 euros from 36% to 34%

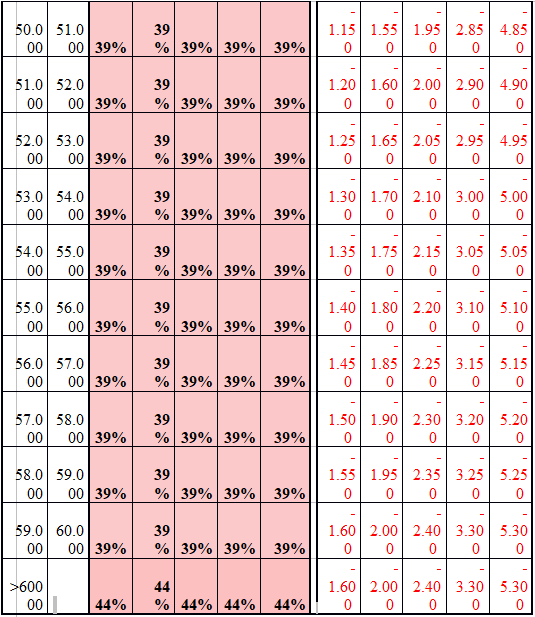

- It is imported from € 40,000 to 60,000 euros 39%, while the rate of 44% will apply to incomes of more than 60,000 euros.

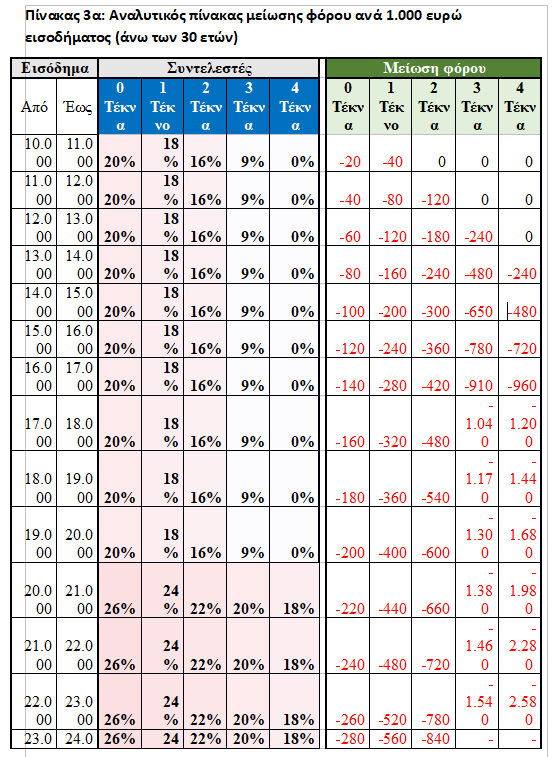

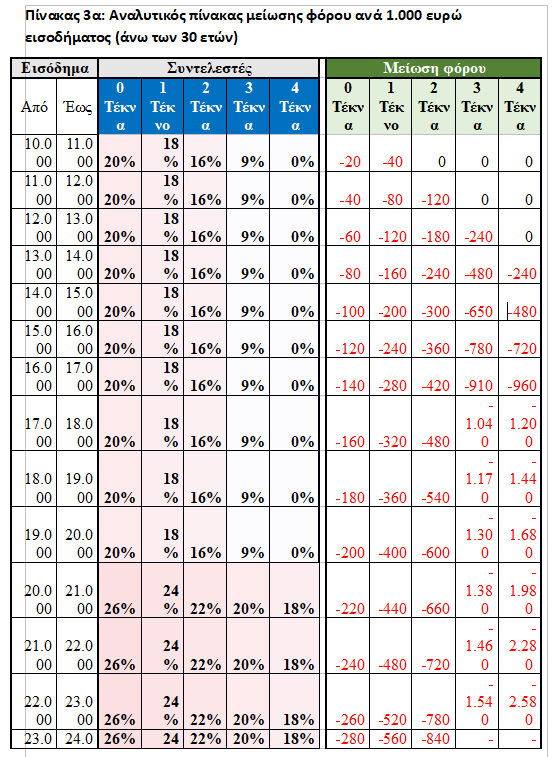

Additional interventions for families with children:

The rate from 10,000 to 20,000 will now amount to 20% for taxpayers without children, decreases further depending on the number of children and even more for three -persons in:

- 18% for taxpayers with 1 dependent child

- 16% for taxpayers with 2 dependent children

- 9% for taxpayers with three dependent children

The rates of 0 to 20,000 euros are zeroed for taxpayers with four or more dependent children. The rate of 20,000 to 30,000 euros will now amount to 26% for taxpayers without children is also reduced by 2 percentage points for each child:

- 24% for taxpayers with 1 dependent child

- 22% for taxpayers with 2 dependent children

- 20% for taxpayers with three dependent children

- 18% for taxpayers with four dependent children

- 16% for taxpayers with five dependent children etc.

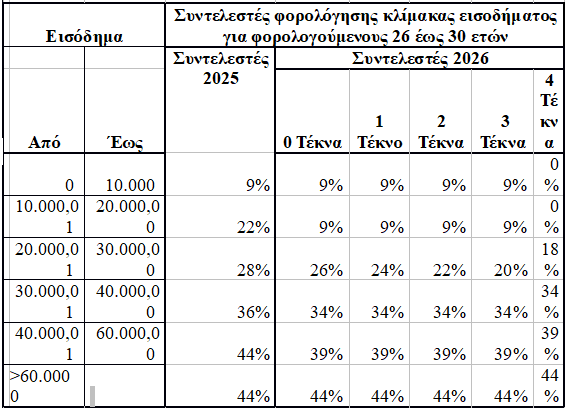

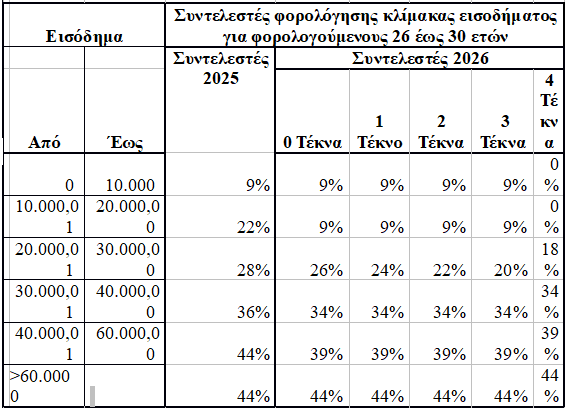

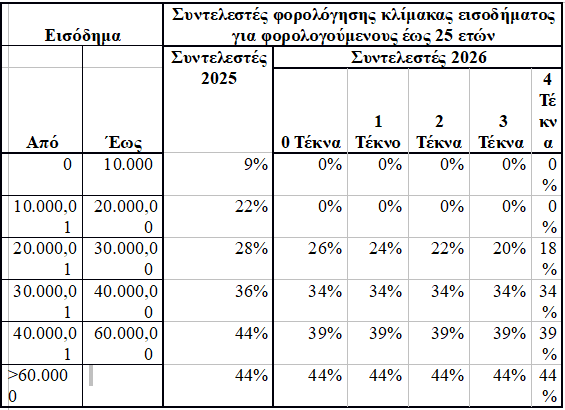

Additional interventions for young people:

- For young people up to 25 years old, rates from 0 to 20,000 euros are reset.

- For young people 26 to 30 years, the rate from 10,000 to 20,000 will be 9%.

The above interventions will be implemented from the tax year 2026 and (a) employees and retirees will see the benefit from the January 2026 payroll by increasing their monthly net earnings as the tax is withheld, (b) individual businesses and farmers will see the taxpayer 20. A total of about 4 million taxpayers are currently beneficial under their income tax.

The budgetary costs are estimated at € 1.2 billion in 2026, € 1.6 billion in 2027 and € 1.53 billion for the years 2028 and next.