In force on Tuesday (1.10.2025) the new electronic applicationthrough which the taxpayers They can calculate the economic benefits of the tax reform for demographic and middle class.

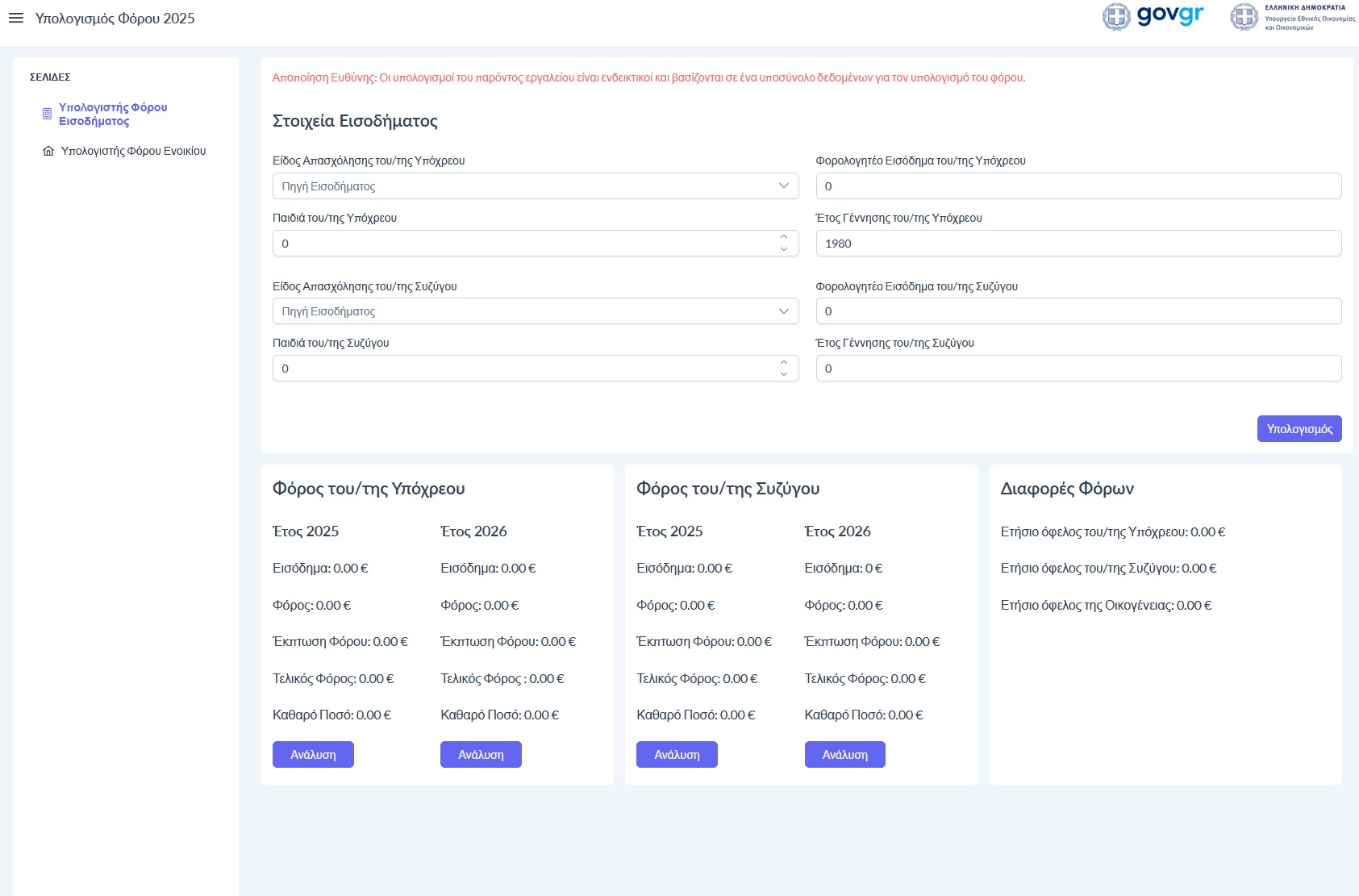

It is an electronic application through which taxpayers can access any browser on a computer (PC/Mac), tablet or mobile phone at the address at the address www.taxcalc2025.minfin.gr.

The application does not use citizens’ tax data, nor does it store data, and does not use cookies. It has been entirely developed by officials of the Ministry of National Economy and Finance and is hosted on the G-Cloud of the Ministry of Digital Government.

In just a few seconds, every citizen can accurately ascertain the tax cuts that will apply from 2026. For employees, these reductions are equivalent to wage increases from January of the new year, while for freelancers the benefit will be made.

How will you calculate the benefit in simple steps

Every citizen can choose the Income tax displayed on the home display or Rent tax.

1. Income Tax Computer

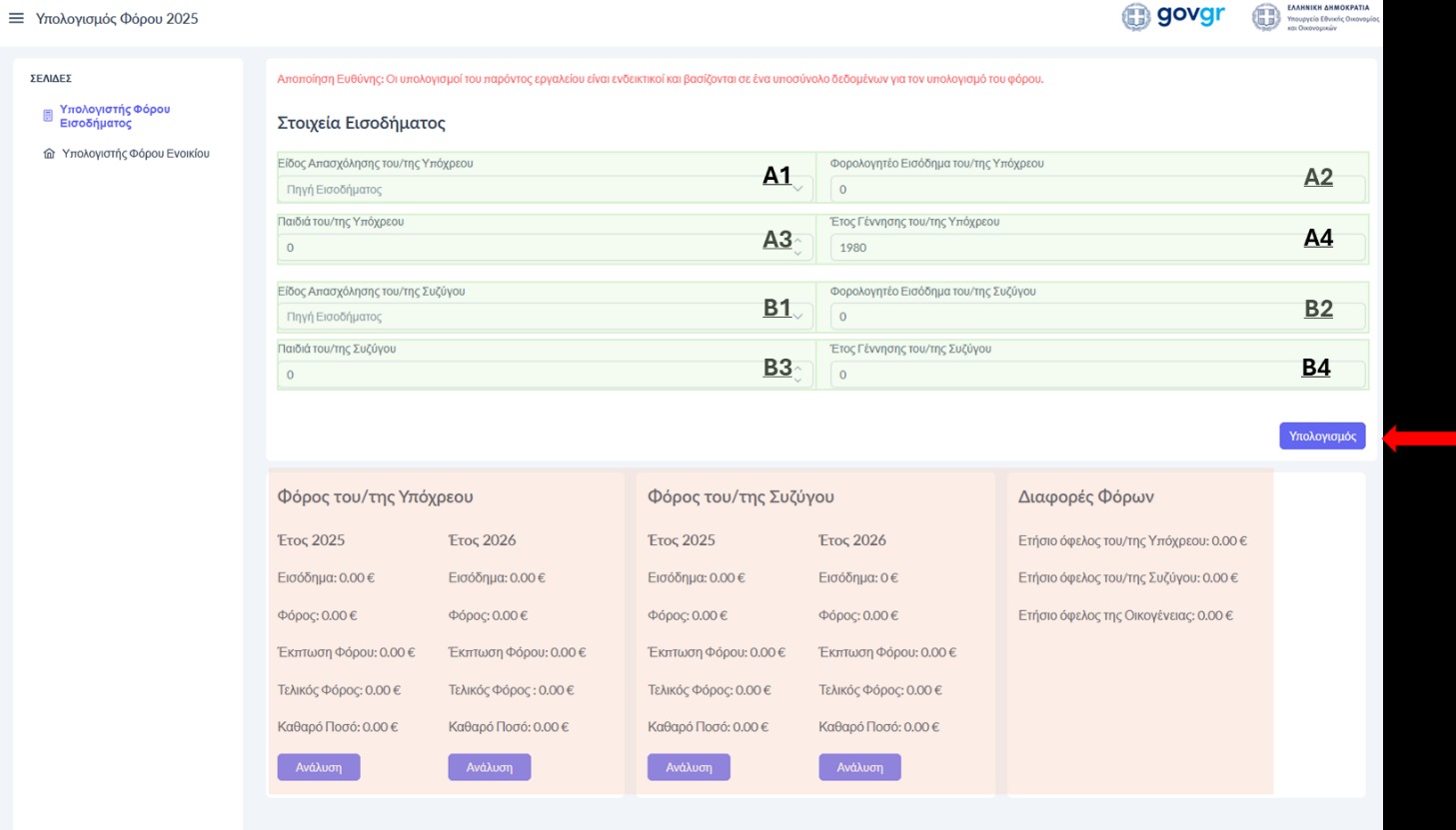

On the income tax display the taxpayer needs to enter the following information (see screen 2 – elements on a green background):

A. For the debtor: A1- Type of employment, A2- taxable income and A3- Children of the Lieutenant and A4- Year of Birth

B. For his/her spouse’s income: B1- Type of employment, B2- taxable income, B3- spouse’s children (who in most cases are the same as the children of the debtor) and B4- year of birth.

If there is no spouse, it leaves the fields empty.

Then the debtor must press the calculation button and the application will automatically calculate the reductions. (Screen 2 – elements in pink background).

The results are displayed for the debtor and the spouse and for the years 2025 and 2026:

- The taxable income

- The scale tax before the tax deduction he has if he is an employee / retired or professional farmer

- The tax deduction he has if he is an employee / retired or professional farmer

- The final scale tax after deduction.

- The net amount resulting

In a separate column, the annual individual benefit of the debtor, the spouse and the family benefit are displayed.

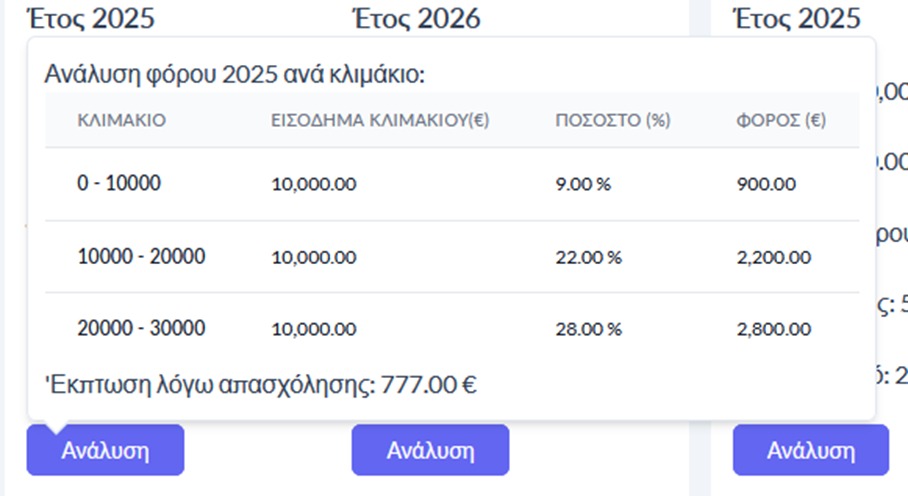

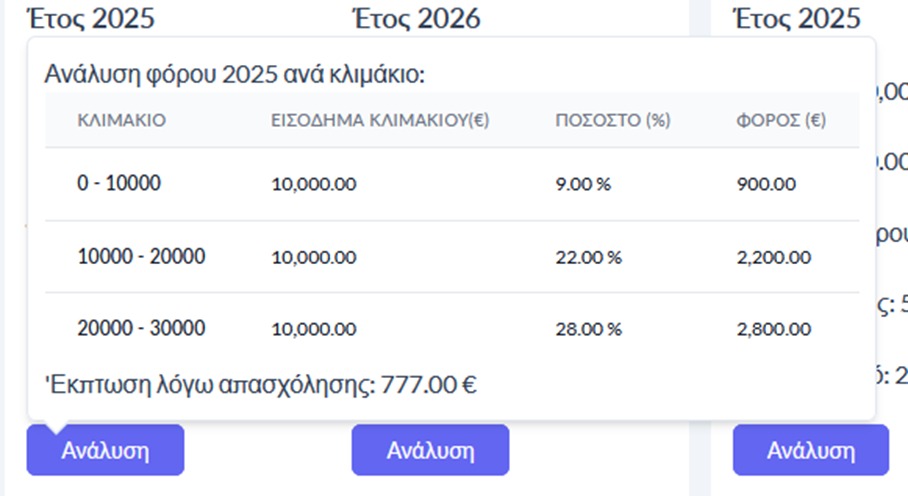

Choosing her Analysisthe justification for the tax calculation (screen 3: Analysis of Income Tax Scale) appears for tax scales and the tax deduction of employees, retirees and farmers, depending on the number of children of each family.

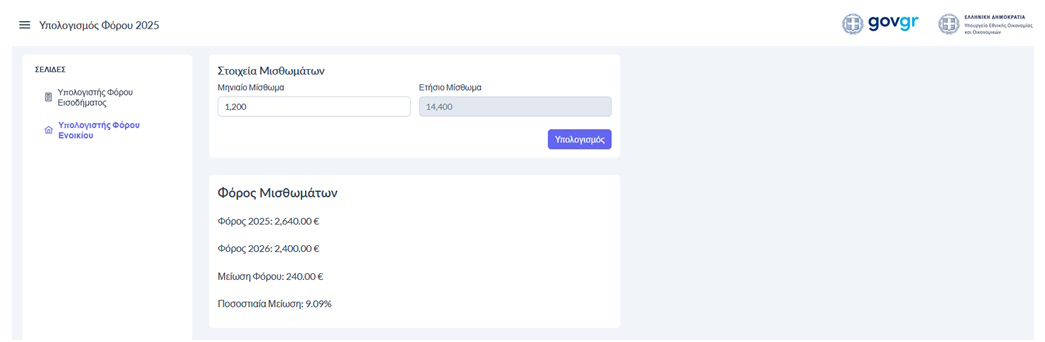

2. Rental tax computer

Choosing to the left menu the Rental Tax The relevant display appears (display 4. Rental Tax Computer). Taxpayers must enter the monthly rent and press the button Calculation.

The application calculates the annual rent, the tax for the year 2025, the tax for the year 2026 the resulting difference and the percentage tax reduction.

Is recalled That, following the adoption of the relevant bill with the TIF measures, which is expected in October, AADE will proceed with the creation of a second platform for calculating benefits. The new platform will automatically draw citizens from its database, offering even more accuracy to the results.