The company continues its dynamic growth in the first six months, offering 9.4 million seats, 5% more than in the first half of 2024, carrying 7.6 million passengers, 4% more than last year. Interior passengers increased by 5% while overseas passengers increased by 4%, despite a significant May-June two-month lag from non-performance of flights to Israel, Lebanon and Jordan due to geopolitical developments.

Despite the restrictions, especially in May – June, but also the increase in the capacity of a significant number of airlines to Greece, Aegean has achieved strong economic performance, from the positive management and maturation of the network, the gradual use of more aircraft of the largest A321neo edition but also the EURO. In operating costs and valuation of future aircraft leases.

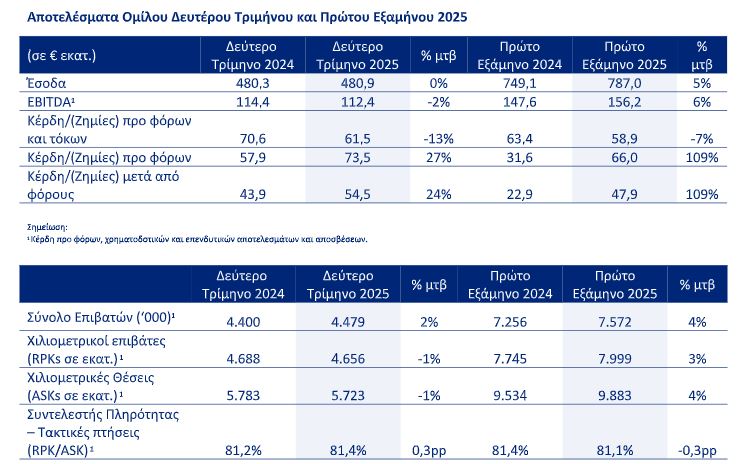

The consolidated turnover in the first half amounted to € 787.0 million, recording a 5%increase. EBITDA increased by 6%, reaching € 156.2 million. Earning pre -tax profits stood at € 66.0 million, compared to € 31.6 million in the first half of 2024, while earnings after tax was € 47.9 million, from € 22.9 million in 2024.

In the second quarter Aegean offered 5.5 million seats, just 2% more than 2024 mainly due to the loss of markets in the Middle East mentioned above, with passenger traffic also increasing by 2%. The fullness factor stood at 81.4%. The consolidated turnover for the second quarter amounted to € 480.9 million, while EBITDA stood at € 112.4 million. Net profit after tax amounted to € 54.5 million, increased from € 43.9 million in the second quarter of 2024.

Cash reserves and immediate liquidity financial data increased to € 841.9 million to 30.06.2025 from € 769.1 million at 31.12.2024, in addition to paying a dividend of € 72.1 million to shareholders at 26.05.2025. It is noted that the cash reserves do not include the additional cash reserve resulting from the issuance of the new bond loan in early July 2025. In 2025, Aegean reinforces its fleet with a total of 6 new aircraft, of which three (3) A320/321NEOs have already been received and ATR 72-600 in the last four months of the year.

Mr. Dimitris Gerogiannis, Managing Director, said:

“In the first half of 2025, Aegean had extremely economical results, despite the significant geopolitical challenges that limited our access to major markets especially in the second quarter.

Demand for travel to and from Greece remains strong with increasing the trips of both Greeks and visitors from abroad and gradually enhancing demand and traditionally weak months.

At the same time, the growing market capacity by a significant number of airlines creates a highly competitive environment, where passengers have more options, while the quality of the product is increasingly important as a diversification element. In this environment, our investments in our people’s training and expanding infrastructure, as well as the fact that the 26 Airbus aircraft we expect to receive are all of the largest A321neo version, are important to enhance our competitiveness.

At the same time in the next 24-28 months from today, we expect the Pratt & Whitney GTF’s premature controls, gradually re-producing all the new aircraft we have received with significant impact on both the unit costs and the development capabilities of our company. At the same time, the gradual arrival of six (6) A321 XLR / LR paves the way for a new level of comfort and services outside the EU but also additions to new remote markets and destinations, with the first step as we announced the India market since early 2026.

Our steps are careful and consistent to ensure the dynamics and creativity of the organization and the stability of our march for our shareholders, our employees and of course our passengers. “

Aegean administration will hold a conference call on discussion “Results of the first semester 2025“, Her Wednesday 17 September 2025 to 16:00 Greek time.