Economic package of height 1.5 billion euros with the main targeting of middle classwhich lifted disproportionate weight over the last decade, is preparing to announce the Kyriakos Mitsotakis by the step of her TIF In early September. The package will concern tax breaksearnings increases mainly to uniforms, accuracy relief measures, mortgage interventions, targeted aid and incentives in areas where the state has to intervene.

The final budgetary burden for 2026 is expected to be greater and may exceed 2 billion euros. The financial staff is planning, as it did this year, a second package of measures For April 2026, which will depend on the course of growth and the primary deficit of 2025 after the validation of the data by Eurostat.

The alternative scenarios have gathered more than 100 proposals that the ministries worked on at the meetings that started in July. From tomorrow in Maximou, the prime minister, along with his financial staff and close associates, will evaluate and finalize measures by the end of August 2025.

The bunch of interventions to be announced by the Prime Minister is designed with a two -year horizon (until the next national elections) and includes:

First: Specialization and implementation of new benefits and measures, which were announced in April this year, but were not provided for in the 2025 budget voted in December. These will be applied immediately before the end of the year.

Second: New measures to be announced for the first time at the TIF. These will be implemented by October 2025 or January 2026.

Thirdly: “After the TIF”, which will be announced to be implemented after March 2026, when the performance of the 2025 economy is ratified by Brussels.

Tax relief

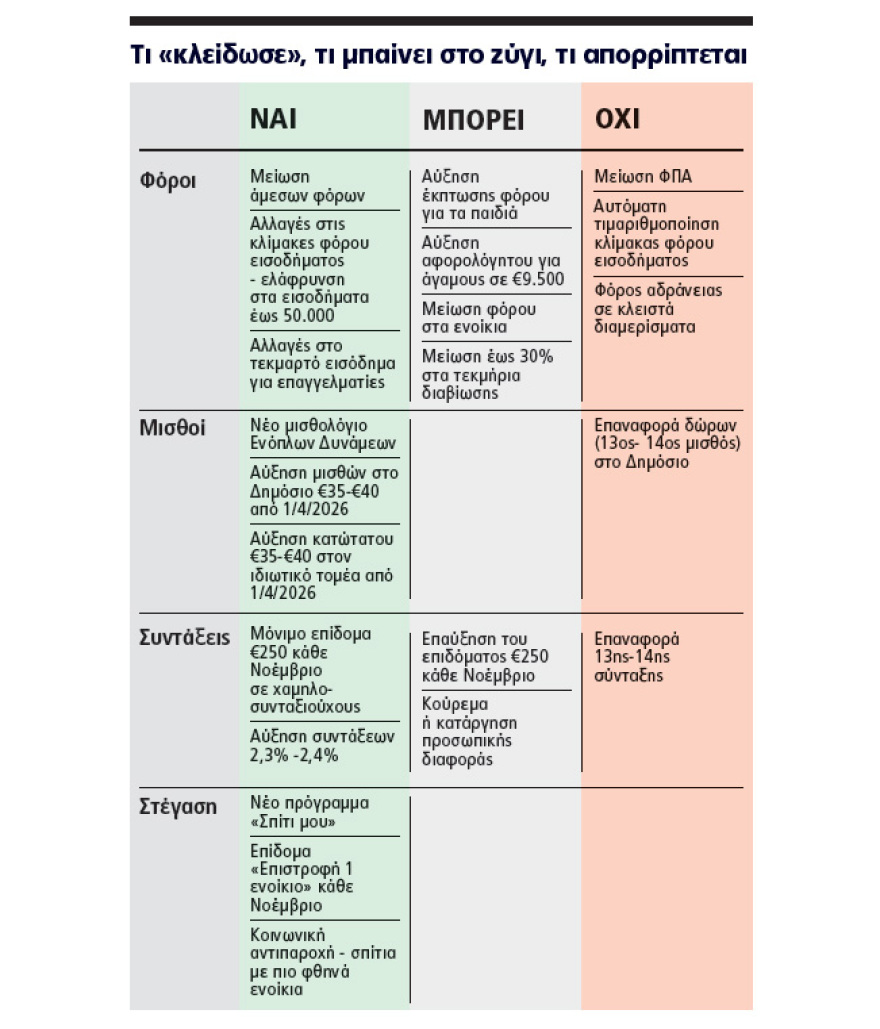

At the center of the measures lies the softening of the middle class, that is, households with incomes to 50,000 eurosas this category of citizens was more pressured at the time of the Memorandums, but also tested after the successive new crises that arise. In a realistic scenario, the combination “profit in pocket” from tax breaks, wage increases, housing aid (over 40 meters in total) will range from 300 to 2,000 euros a year for over 4 million employees, professionals, retirees and owners. The government’s plan has received the green light from the Commission that it does not violate financial boundaries and rules. Thus, the stability of the national economy is not threatened with the awaiting positive reports by the Commission and international organizations, as well as the upgrades our country needs from the rating agencies (Moody’s on September 19, Standard and Poor’s on October 18th, Fitch in November and so on. In this direction, the government seems to finally abandon the taxation rates for taxation of the tax scale, that is, the automatic annual adjustment of inflation -based income tax scales. The reason is that if inflation insists one year (increased to 3.1% in July and had reached 9% a few years ago), the budgetary cost of implementation would reach $ 1 billion a year, threatening the country’s budget and financial stability. They also repel the levies to reinstate gifts to pensions and the State, which would cost 3 and 5 billion euros a year respectively, while excluding new VAT reductions and the introduction of tax disincentives (inactivity tax) in homes that remain closed instead of being leased.

In compensation, the financial staff qualifies a brave -but a lump sum and not repeated every year- Change of tax scalewhich will give a medium income of up to 50,000 euros a year, with a focus on families with children. Changes will apply to incomes obtained from 1.1.2026 and declared in 2027. Thus, employees and retirees will see immediate benefit – due to a reduction in tax withholding – in each of their payment from January 2026. 1,500 or even 2,000 euros on a twelve -month basis, that is, almost a whole middle wage. The individual scenarios examined include many significant changes in the tax scale, which are planned to apply even at the same time.

Specifically:

■ Creating a lower intermediate tax rate of 15% in the part of the income from 10,001 to 16,000 euros per year. The aim is to smooth out the tax ejecting today for anyone who passes from the 9% rate (in incomes up to 10,000 euros) at the rate of 22%. In itself, this measure can generate an annual relief of up to 420 euros for employees or retirees living with a monthly income of € 1,000 and more net.

■ Adjustments to both the upper parties, but also to the maximum income tax rate. Today, the high rate is 44%, but is activated for incomes of 40,000 euros or more. That is, it catches salaries of 2,850 euros a month, a level that is considered relatively low for the data of a middle class family. It is thus considered to start at 45,000 or 50,000 euros or more or reduce by 2 to 4 percentage points, to 42% or 40%. In the pocket such a reduction would generate an additional EUR 1,000 to 2,000 euros per year (depending on how it will eventually be applied) for incomes of more than 40,000 or even 50,000 euros a year.

■ Change in scales and rates can be upward and (indirect) tax -free salaried, retirees and farmers who has been locked up at € 8,636 for the unmarried, at 9,500 or 10,000 euros. This change has a symbolic but also practical objective: Reduction of tax -free to 8,636 euros was imposed as a memorandum in 2016 and resulted in paying income tax even employees living with just 620 euros a month. Because of it, 2 million households are seeing wage increases that have taken over the last five years from the extremely low tax -free threshold. The pressure of accuracy enhances the intentions to tackle the tax trap created by the constant increases in the minimum wage. The tax-free increase would add another 100-120 euros per year to taxpayers’ net income.

■ Alternatively and targeted, however, it is considered to be more tax-free only to families with children, beyond 1,000 euros per child already in force in 2024. Combined, the tax-free for families with children can start at € 11,000 or more, offering enhanced benefits of an additional EUR 150-220 for each child. Today, a family -free family with one child reaches 10,000 euros, for two children at 11,000 euros and with three children at 12,000 euros.

■ In addition, the tax package also introduces a gradual haircut of living documents. They are being rationalized and reduced by 30%, gradually, by 2027. This development will give a breath to over 1.5 million households – most of them employees and retirees – who pay an additional tax of around 300 euros, but not for taxable income.

Pensioners

Initial suggestion for pensioners provided for full abolition of personal differencethrough its integration into the main pensions, so about 500-600 thousand old pensioners In 2016, they fell victim to the Katrougalos law to begin to get those annual increase every year – as they are offset so far and simply reduces the personal difference in their pension gradually until it is reset. The alternative – but predominant – scenario, however, combines the partial or even complete abolition of personal difference in pensions. It follows the logic of the measure this year to the active civil servants who have a personal difference in their salaries. That is, those who have up to 300 euros in personal difference, the annual increase is not offset but receive it normally in their salary. However, because the average personal difference in pensions is less than that of the active civil servants, this threshold will be lower at 150 or 200 euros.

In addition, pensioners are expected to receive a new permanent allowance this year, in addition to the established annual increase of 2.3%-2.4%, associated with inflation and GDP. The 250 euro allowance will be given in November this year and each year. Although a permanent measure announced since April this year, an effort is being made to adjust and increase so that it may reach 300 euros. The measure is about 1.1 million pensioners and 350,000 beneficiaries from vulnerable groups. Beneficiaries are unmarried with an annual income of up to EUR 14,000 (salary or pension of up to EUR 1,000 per month) and assets of up to EUR 200,000 for unmarried or income up to € 26,000 and assets of EUR 300,000 for married.

Wages

Significant increases They are expected to be announced for workers in the Armed Forces and the State in general. Specifically:

■ New payroll in the Armed Forces. Although announced, it has not specialized and yet announced precisely how and how much it will benefit. It is estimated that it will generate up to half a salary of an extra year for several executives.

■ Increase in the minimum, although it will not be announced, as final decisions will be announced in March: from April 1, 2026, the minimum wage in the private sector is expected to increase from EUR 880 to EUR 915 or EUR 920 gross, an increase of 250-300 euros per year for more than € 1 million in the year. Minute, with a collective agreement or with bonuses linked – and increasing – to the minimum wage.

■ Increases for everyone in the State: As of April 1, 2026, a new horizontal increase of EUR 35-40 per month (about EUR 200-250 per year is purely extra) is forecast on all salaries. The increases are linked to the course of the minimum wage in the private sector, with the aim of the import salary of the State to reach 950 euros by 2027. For the impact of the accuracy the government chooses to further increase the minimum wage and specific support measures wherever and when conditions require it.

Professional

Part of the package also includes changes in the presumption of professionals and self -employed people with the aim of fairer distribution of tax burdens. New targeted interventions and corrections will be announced imputed incomeWhether they relate to horizontal entire professional sectors with significant particularities in their operation (eg school canteens), or geographical areas of the country, such as municipalities or communities with below 500 inhabitants, where professionals lost the specific discounts (up to 50%) provided by law because they are underlyed by law. Thus, more professionals will be taxed for significantly lower imputed income, now paying less tax. At the same time, professionals will benefit from the change of scales and the haircut of living expenses, which will automatically bring 300-500 euros to the tax imposed by the tax office of the house where they reside or the car, vessels, etc.

Kostis Ch. Plantzos