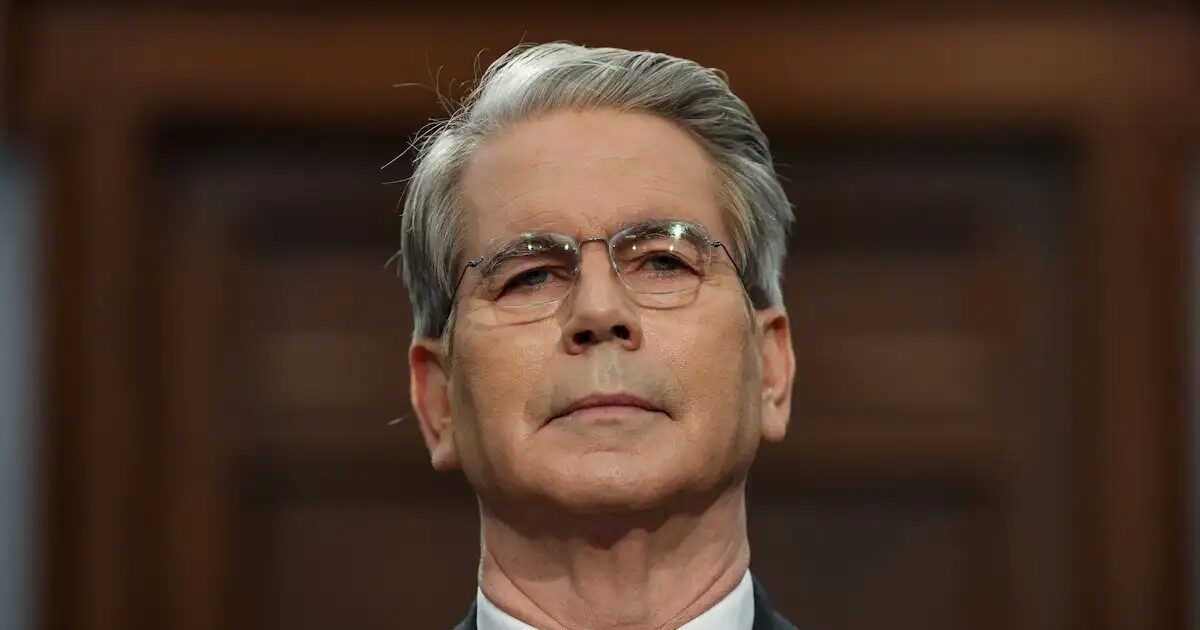

US Finance Minister Scott Bessed assured yesterday (26.6.2025) that an agreement will be concluded with G7 countries that will allow US companies to be excluded from some taxes internationally.

“After months of productive talks with other countries on the global tax agreement of the Organization for Economic Cooperation and Development (OECD), we will announce a joint agreement with the G7 countries defending US interests,” Scott Besed said via X. nearly 140 countries have drafted 20 countries.

The deal, strongly criticized by US President Donald Trump, included two “pillars”, with the latter setting the world minimum tax rate of 15% for multinational companies.

But according to Bessed, “the taxes of the second OECD pillar will not apply to US companies.” Officials are working to present and implement this agreement within “months”, he added.

Bessed also called on members of the US Parliament to withdraw President Trump’s “big and beautiful law”, currently under discussion in Congress, to withdraw a provision that the government allows to impose taxes on businesses whose owners are not investigators.

This clause, which was intended to be able to impose tax retaliation, had caused many concerns, especially for the possibility of preventing foreign companies from investing in the US.