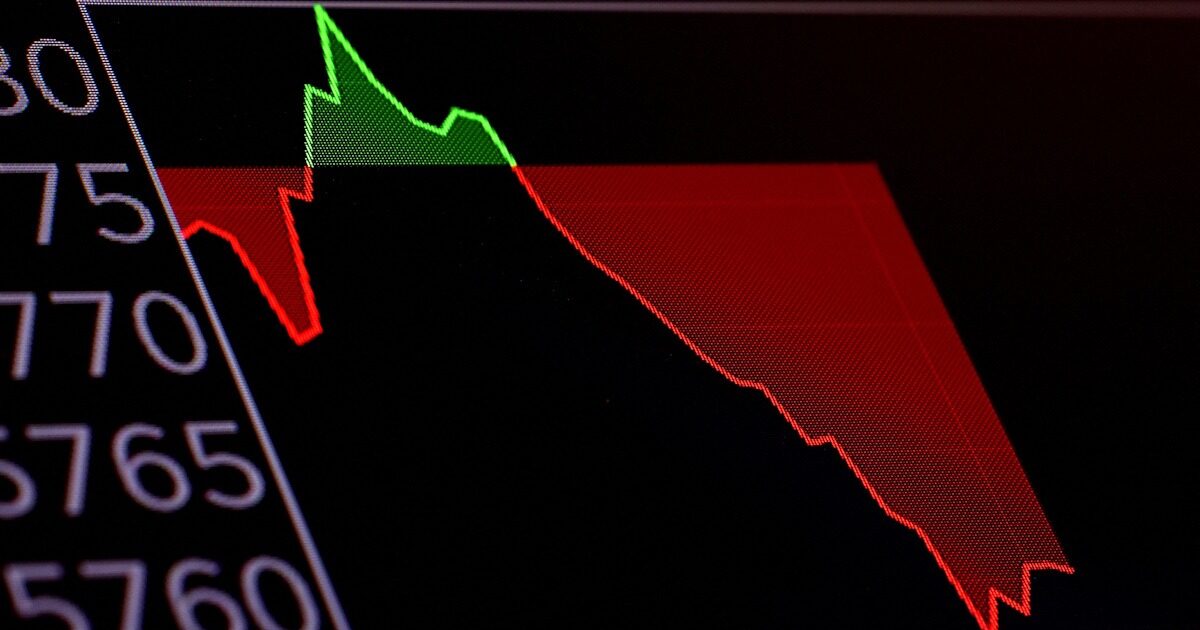

Most markets her Middle East They retreated today (15.6.2025) on their first day of negotiation, as investors expressed increasing concerns about a broader conflict amid Iran and Israel conflict.

Its main stock market index Egypt Head of the Middle East stock market losses, had the worst performance between the markets that were first opened since the start of the attack on Friday (13.6.2025).

He has noted the biggest losses of the last five years at one point due to concerns that the interruption of Israeli gas production would lead to fuel deficiencies in the country dependent. Egypt’s currency was weakened by exceeding the $ 50 per dollar threshold in local banking.

The shares reference index Israel Tel Aviv Stock Exchange 35 deleted the losses it had at its beginning (-1.5%), as the defensive supplier Elbit Systems rose. To Saudi Arabiathe fall of the Tadawul All Share Index index was limited by Aramco, which won due to the highest oil prices.

The escalation comes at a difficult time for the Middle East shares, as they have so far undergone global markets, drifting away from the volatility of oil prices, geopolitical uncertainty and fiscal pressures in some countries, including Saudi.

The events of this weekend have already reduced hopes of fast ending hostilities and have enhanced demand for assassination assets such as gold and dollar.

Long -term hostility Israel and Iran broke out in open conflict after hostilities in Gaza and Lebanon. It has already led to the cancellation of nuclear talks between Iran and the US and undermined the cross bets in the area, which were foreseen in the return of peace.

Egypt’s EGX 30 index sank up to 7.7%before limiting losses. All 31 shares fell, while the pound was negotiating as weak as 50.6 points per dollar, according to local banks. Israel interrupted production in its largest natural gas field over the weekend, interrupting supplies to Egypt.

Israel’s stock market index rose 0.6%, eliminating losses of up to 1.5%, thanks to the leap of defensive Elbit supplier. The manufacturer of missile, unmanned aircraft and air defense systems for the Israeli army said last month that it was betting on its activities in Europe.

The Saudi Arabian market was mostly involved in the sale, as 243 of the 253 shares of the report index were losses. However, the impact was offset by Saudi Aramco’s profits, which increased by 1.2% thanks to rising crude prices on Friday. Other markets throughout the area, including Kuwait and Qatar, have retreated.

Investors’ basic concern remains the oil supply chain and prices. Futures of the future West Texas Intermediate has made more than 7% to be close to close to $ 73 a barrel on Friday, for the largest daily jump since March 2022.