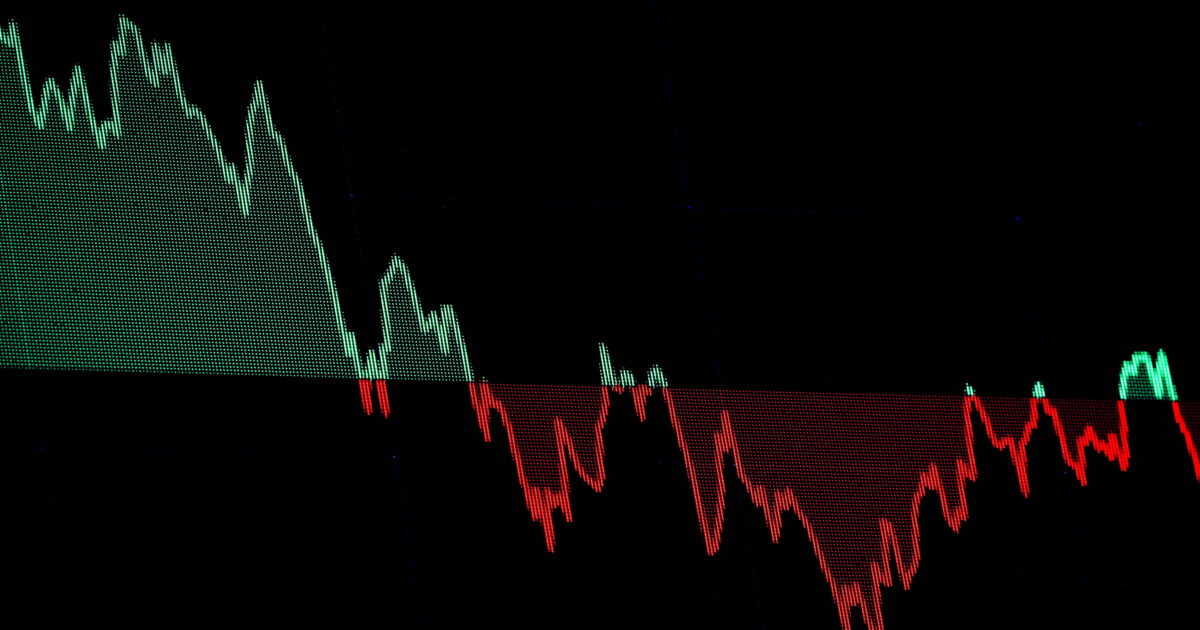

Losses records its basic indicators Wall Street Today Monday (2.6.2025), the first day of June negotiation, with investors being unpleasant by US President Donald Trump’s plans to double the duties in steel and aluminum at 50% from 25% – starting on Wednesday (Wednesday). USA.

Industrial Dow Jones on Wall Street is down 0.62% or 260 points, as global commercial tensions have increased. The S&P 500 also declines by 0.26%, while Nasdaq is around the flat line. China reacted to the US allegations that it has violated a temporary trade agreement. On the contrary, the country accused Washington of not complying with the agreement – a sign that negotiations between the world’s two largest economies are deteriorating.

Tensions were rekindled after a brief pause after meeting US Finance Minister Scott Bessed and Chinese Vice President of the Chinese government in Geneva and the agreement to suspend most of the tariffs for 90 days. White House official told CNBC’s Jovers today that President Donald Trump and China President Xi Jing are likely to speak this week.

The 30-year US bond has undergone in 2025. Duration yields have increased, while yields of 2-, 5- and 10-year bonds have declined. This kind of divergence is rare – the last time it happened for a whole year was in 2001 – underlining the pressure exerted on the long -term bond, as investors demand additional compensation to lend the US government for such a long time.

The decline was so bad that speculation began to circulate that the Treasury could reduce or stop the auctions of its longer -term counterparts.