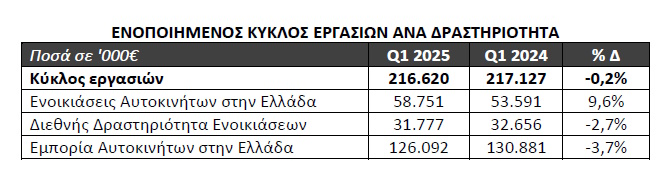

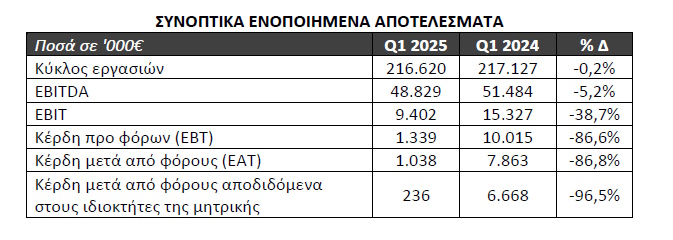

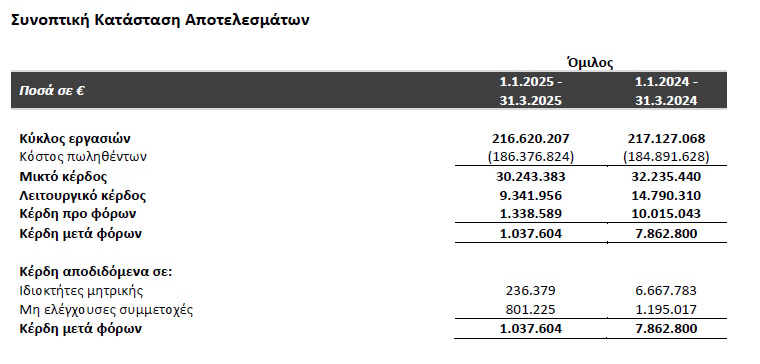

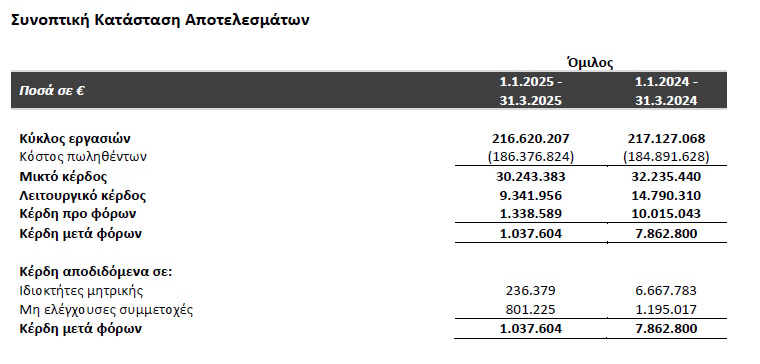

OR Autonellas announces the results of the first quarter of 2025, with the consolidated turnover of € 216.6 million, and EBITDA standing at EUR 48.8 million versus € 51.5 million in the corresponding quarter last year.

Consolidated turnover of 216 million, with EBITDA 48.8 million.

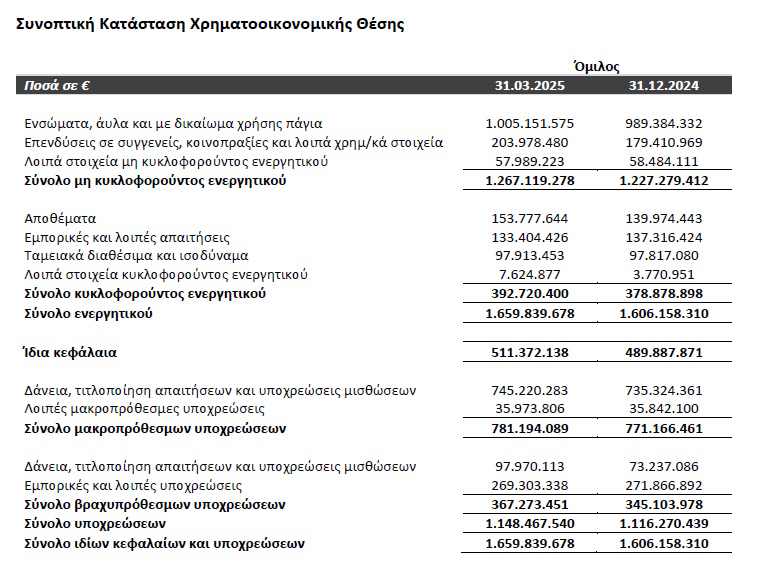

The corresponding profits after Autohellas taxes are € 1 million, with a decrease in profitability, in the weakest seasonal quarter, to be attributed mainly to the absence of extraordinary profits recorded in 2024 earnings from profits from the closure of interest rates (Swaps). The group’s equity on 31.3.2025 stood at € 511.4 million.

Leases

The turnover of car rental activity in Greece increased by 9.6% in the first quarter of 2025 compared to the first quarter of 2024, reaching € 58.7 million, with the increase coming from both short -term and long -term leases.

In particular, short -term leases have benefited from the increased demand for the domestic market and increased tourist arrivals – despite the fact that this is the traditional weaker quarter of the year – in an environment of restrained rental prices.

In long -term leases, a significant increase in new vehicles were received, reflecting the increased demand and new contracts that have been concluded, which has contributed substantially to further expansion of the fleet.

Overseas activity

The turnover of international activity related to car rentals, reached a total of 31.7m euros from € 32.6 million in the first quarter of 2024. The increased availability of fleet of vehicles continued to put in pressure on rental prices, leading to a mild decline in prices compared to 202.

This development has influenced operating profitability, mainly in the Portuguese market, which remains the only country in the group where the Operating Leasing service is not offered.

Trading of cars and services

In the first quarter of 2025, the activity of car trading in Greece showed a slight decrease in turnover by 3.7%, contributing a total of 126.1m euros to the group’s turnover. This reduction is mainly attributed to the retreat of the total market in the first trimester, as well as to the intensity of competition due to the entry of new manufacturers and brands into the Greek market.

It is noted that the activity of Italian Motion (Fiat/Jeep/Alfa Romeo) that does not participate in the consolidated turnover (accounting only by the net position method), presented sales of EUR 34.6 million in the first quarter of 2024, which further enhances the overall activity and potential of the group.

The dynamics of tourist arrivals of the first quarter of the year is estimated to continue in the next period, positively affecting the demand for short -term leases.

The company in the current use has invested in a large number of cars aimed at enriching and upgrading the fleet with larger cars. At the same time, long -term leases continue to show a growing trend in both conventional and hybrid and electric cars this year.